Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does (NYSE:EMC) fit the bill? Let’s take a look at what its recent results tell us about its potential for future gains.

What we’re looking for

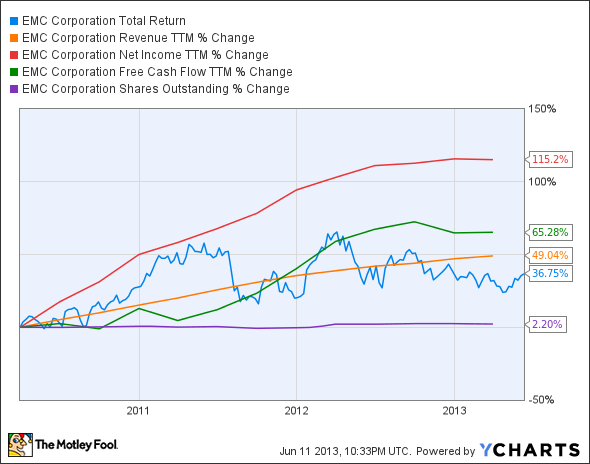

The graphs you’re about to see tell EMC Corporation (NYSE:EMC)’s story, and we’ll be grading the quality of that story in several ways:

1). Growth: Are profits, margins, and free cash flow all increasing?

2). Valuation: Is share price growing in line with earnings per share?

3). Opportunities: Is return on equity increasing while debt to equity declines?

4). Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at EMC Corporation (NYSE:EMC)’s key statistics:

EMC Total Return Price data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 49% | Pass |

| Improving profit margin | 12.4% | Pass |

| Free cash flow growth > Net income growth | 65.3% vs. 115.2% | Fail |

| Improving EPS | 104.2% | Pass |

| Stock growth (+ 15%) < EPS growth | 36.8% vs. 104.2% | Pass |

Source: YCharts. * Period begins at end of Q1 2010.

EMC Return on Equity data by YCharts.

| Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 47.8% | Pass |

| Declining debt to equity | (61.8%) | Pass |

| Dividend growth > 25% | Initiated in 2013 | Pass |

| Free cash flow payout ratio < 50% | Not yet established | N/A |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we’re going

EMC Corporation (NYSE:EMC) puts together a really strong performance, missing out on a perfect score only because net income has outpaced free cash flow during our tracked period — however, the raw numbers show that EMC’s trailing-12-month free cash flow is actually almost twice as large as its net income. That makes it an even more appealing value, as its price-to-free cash flow ratio is presently barely in double-digit territory. But does that mean EMC will keep outperforming in the future? Let’s dig a little deeper.

Six months ago, my colleague Selena Maranjian looked at the pros and cons of EMC, noting that EMC Corporation (NYSE:EMC)’s majority ownership of cloud specialist VMware, Inc. (NYSE:VMW) offers beneficial synergies that boost both companies. EMC’s networked storage solutions aren’t free from competition, however, since the primary advantage in this arena is simple cost and convenience. VMware has since slid from its 2012 levels following disappointing growth reports, which is less a concern for EMC since VMware, Inc. (NYSE:VMW) is still growing — just not as quickly. EMC also happens to be outpacing NetApp Inc. (NASDAQ:NTAP) in direct competition, as the latter’s 4% product revenue growth came in below EMC’s result earlier this year.

EMC also benefits from excellent corporate governance, which allows investors to feel comfortable knowing that their shares should be free from any insider shenanigans. That won’t prevent EMC from suffering if its core business comes under attack, but long-term investors know that nothing is risk-free.