We at Insider Monkey have gone over 742 13F filings that hedge funds and prominent investors are required to file by the government. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article, we will look at what those funds think of Dollar Tree, Inc. (NASDAQ:DLTR) based on that data.

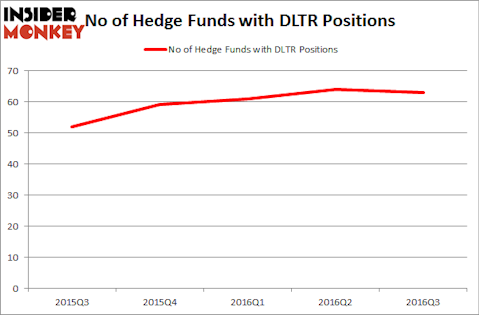

Dollar Tree, Inc. (NASDAQ:DLTR) has experienced a slight decrease in hedge fund sentiment in recent months. At the end of September, Dollar Tree was included in the equity portfolios of 63 funds in our database, down from 64 funds a quarter earlier. At the end of this article we will also compare DLTR to other stocks including St. Jude Medical, Inc. (NYSE:STJ), Discover Financial Services (NYSE:DFS), and Corning Incorporated (NYSE:GLW) to get a better sense of its popularity.

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Follow Dollar Tree Inc. (NASDAQ:DLTR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Nejron Photo/Shutterstock.com

With all of this in mind, we’re going to review the fresh action encompassing Dollar Tree, Inc. (NASDAQ:DLTR).

What does the smart money think about Dollar Tree, Inc. (NASDAQ:DLTR)?

As stated earlier, heading into the fourth quarter of 2016, 63 funds tracked by Insider Monkey were bullish on this stock, down by 2% over the quarter. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Lone Pine Capital, managed by Stephen Mandel, holds the most valuable position in Dollar Tree, Inc. (NASDAQ:DLTR). Lone Pine Capital has a $1.22 billion position in the stock, comprising 5.4% of its 13F portfolio. The second largest stake is held by Charles Akre’s Akre Capital Management, which disclosed a $330.4 million position; 6.3% of its 13F portfolio is allocated to the company. Other peers that hold long positions contain Panayotis Takis Sparaggis’s Alkeon Capital Management, and Steve Cohen’s Point72 Asset Management.

Due to the fact that Dollar Tree, Inc. (NASDAQ:DLTR) has witnessed bearish sentiment from the aggregate hedge fund industry, we can see that there is a sect of fund managers who sold off their entire stakes during the third quarter. It’s worth mentioning that Martin D. Sass’s MD Sass said goodbye to the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at close to $55.6 million in stock. Ricky Sandler’s fund, Eminence Capital, also cut its stock, about $54.4 million worth.

Let’s check out hedge fund activity in other stocks similar to Dollar Tree, Inc. (NASDAQ:DLTR). These stocks are St. Jude Medical, Inc. (NYSE:STJ), Discover Financial Services (NYSE:DFS), Corning Incorporated (NYSE:GLW), and Mylan Inc. (NASDAQ:MYL). All of these stocks’ market caps are similar to DLTR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| STJ | 54 | 3180378 | 0 |

| DFS | 38 | 671018 | 2 |

| GLW | 36 | 661996 | 4 |

| MYL | 39 | 1819090 | -5 |

As you can see these stocks had an average of 42 funds with bullish positions and the average amount invested in these stocks was $1.58 billion. That figure was $3.99 billion in DLTR’s case. St. Jude Medical, Inc. (NYSE:STJ) is the most popular stock in this table. On the other hand Corning Incorporated (NYSE:GLW) is the least popular one with only 36 bullish hedge fund positions. Compared to these stocks Dollar Tree, Inc. (NASDAQ:DLTR) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.