The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Covenant Transportation Group, Inc. (NASDAQ:CVTI).

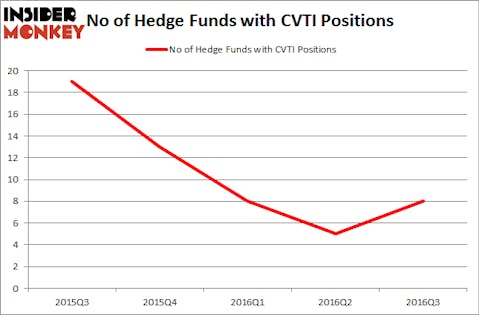

Covenant Transportation Group, Inc. (NASDAQ:CVTI) investors should pay attention to an increase in support from the world’s most successful money managers in recent months. CVTI was in 8 hedge funds’ portfolios at the end of the third quarter of 2016. There were 5 hedge funds in our database with CVTI positions at the end of the previous quarter. At the end of this article we will also compare CVTI to other stocks including NQ Mobile Inc (ADR) (NYSE:NQ), Park Electrochemical Corp. (NYSE:PKE), and Western Asset High Yield Defined Opportunity Fund Inc. (NYSE:HYI) to get a better sense of its popularity.

Follow Covenant Logistics Group Inc. (NASDAQ:CVLG)

Follow Covenant Logistics Group Inc. (NASDAQ:CVLG)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

IM_photo/Shutterstock.com

Keeping this in mind, let’s take a glance at the recent action encompassing Covenant Transportation Group, Inc. (NASDAQ:CVTI).

What have hedge funds been doing with Covenant Transportation Group, Inc. (NASDAQ:CVTI)?

At Q3’s end, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 60% from the second quarter of 2016. By comparison, 13 hedge funds held shares or bullish call options in CVTI heading into this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the biggest position in Covenant Transportation Group, Inc. (NASDAQ:CVTI). Renaissance Technologies has a $4.6 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is Anand Parekh of Alyeska Investment Group, with a $3.4 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other professional money managers with similar optimism contain Matthew Lindenbaum’s Basswood Capital, Alexander Mitchell’s Scopus Asset Management and Ken Fisher’s Fisher Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were breaking ground themselves. Alyeska Investment Group, led by Anand Parekh, assembled the most outsized position in Covenant Transportation Group, Inc. (NASDAQ:CVTI). Alyeska Investment Group had $3.4 million invested in the company at the end of the quarter. Glenn Russell Dubin’s Highbridge Capital Management also initiated a $1.4 million position during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s also examine hedge fund activity in other stocks similar to Covenant Transportation Group, Inc. (NASDAQ:CVTI). We will take a look at NQ Mobile Inc (ADR) (NYSE:NQ), Park Electrochemical Corp. (NYSE:PKE), Western Asset High Yield Defined Opportunity Fund Inc. (NYSE:HYI), and OncoMed Pharmaceuticals Inc (NASDAQ:OMED). This group of stocks’ market caps match CVTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NQ | 8 | 10417 | 1 |

| PKE | 7 | 80580 | 0 |

| HYI | 1 | 2363 | -1 |

| OMED | 14 | 56730 | 6 |

As you can see these stocks had an average of 7.5 hedge funds with bullish positions and the average amount invested in these stocks was $38 million. That figure was $18 million in CVTI’s case. OncoMed Pharmaceuticals Inc (NASDAQ:OMED) is the most popular stock in this table. On the other hand Western Asset High Yield Defined Opportunity Fund Inc. (NYSE:HYI) is the least popular one with only 1 bullish hedge fund positions. Covenant Transportation Group, Inc. (NASDAQ:CVTI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard OMED might be a better candidate to consider taking a long position in.

Suggested Articles:

Most Prestigious Jobs In America

Countries With The Highest Rates Of Human Trafficking

Cities With Highest Demand For Civil Engineers

Disclosure: None