It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Unifi, Inc. (NYSE:UFI).

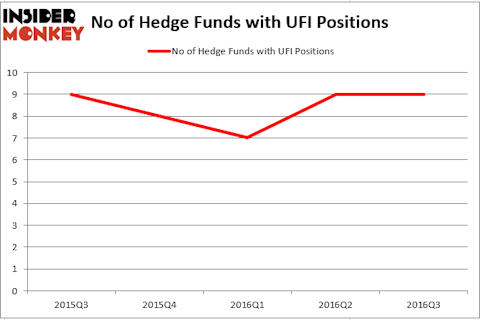

Unifi, Inc. (NYSE:UFI) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as AtriCure Inc. (NASDAQ:ATRC), Armstrong Flooring Inc (NYSE:AFI), and World Point Terminals LP (NYSE:WPT) to gather more data points.

Follow Unifi Inc (NYSE:UFI)

Follow Unifi Inc (NYSE:UFI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

How have hedgies been trading Unifi, Inc. (NYSE:UFI)?

At Q3’s end, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in UFI at the beginning of this year. With the smart money’s sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Robert Bishop’s Impala Asset Management has the biggest position in Unifi, Inc. (NYSE:UFI), worth close to $35 million, amounting to 2.3% of its total 13F portfolio. On Impala Asset Management’s heels is Royce & Associates, led by Chuck Royce, which holds a $14.1 million position. Other hedge funds and institutional investors with similar optimism consist of Richard S. Meisenberg’s ACK Asset Management, Renaissance Technologies, one of the biggest hedge funds in the world, and Cliff Asness’ AQR Capital Management. We should note that Impala Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s now review hedge fund activity in other stocks similar to Unifi, Inc. (NYSE:UFI). We will take a look at AtriCure Inc. (NASDAQ:ATRC), Armstrong Flooring Inc (NYSE:AFI), World Point Terminals LP (NYSE:WPT), and PGT, Inc. (NASDAQ:PGTI). This group of stocks’ market valuations match UFI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATRC | 17 | 43840 | 2 |

| AFI | 15 | 216726 | -1 |

| WPT | 3 | 18183 | -1 |

| PGTI | 14 | 73165 | 1 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $68 million in UFI’s case. AtriCure Inc. (NASDAQ:ATRC) is the most popular stock in this table. On the other hand World Point Terminals LP (NYSE:WPT) is the least popular one with only 3 bullish hedge fund positions. Unifi, Inc. (NYSE:UFI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ATRC might be a better candidate to consider taking a long position in.

Disclosure: None