The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Anthera Pharmaceuticals Inc (NASDAQ:ANTH).

Hedge fund interest in Anthera Pharmaceuticals Inc (NASDAQ:ANTH) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Virtus Total Return Fund (NYSE:DCA), Anavex Life Sciences Corp. (NASDAQ:AVXL), and Endocyte, Inc. (NASDAQ:ECYT) to gather more data points.

Follow Anthera Pharmaceuticals Inc (OTC:ANTH)

Follow Anthera Pharmaceuticals Inc (OTC:ANTH)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

Keeping this in mind, we’re going to go over the latest action regarding Anthera Pharmaceuticals Inc (NASDAQ:ANTH).

Hedge fund activity in Anthera Pharmaceuticals Inc (NASDAQ:ANTH)

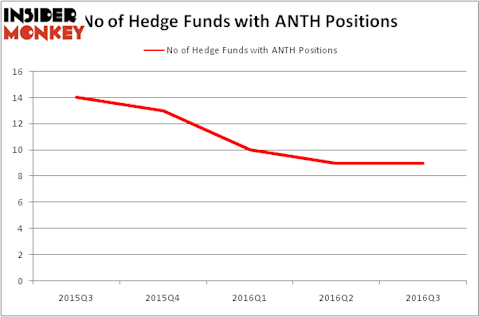

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ANTH over the last 5 quarters. With hedge funds’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Joseph Edelman’s Perceptive Advisors has the biggest position in Anthera Pharmaceuticals Inc (NASDAQ:ANTH), worth close to $4.6 million, corresponding to 0.3% of its total 13F portfolio. Coming in second is Kevin Kotler of Broadfin Capital, with a $3.6 million position; 0.3% of its 13F portfolio is allocated to the stock. Other peers that are bullish contain Michael Castor’s Sio Capital, Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Hal Mintz’s Sabby Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: 999. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s now take a look at hedge fund activity in other stocks similar to Anthera Pharmaceuticals Inc (NASDAQ:ANTH). These stocks are Virtus Total Return Fund (NYSE:DCA), Anavex Life Sciences Corp. (NASDAQ:AVXL), Endocyte, Inc. (NASDAQ:ECYT), and Cherry Hill Mortgage Investment Corp (NYSE:CHMI). This group of stocks’ market valuations resemble ANTH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DCA | 4 | 25711 | 0 |

| AVXL | 4 | 722 | 2 |

| ECYT | 6 | 7231 | 0 |

| CHMI | 4 | 14936 | 0 |

As you can see these stocks had an average of 4.5 hedge funds with bullish positions and the average amount invested in these stocks was $12 million. That figure was $14 million in ANTH’s case. Endocyte, Inc. (NASDAQ:ECYT) is the most popular stock in this table. On the other hand Virtus Total Return Fund (NYSE:DCA) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Anthera Pharmaceuticals Inc (NASDAQ:ANTH) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Suggested Articles:

Countries With Free Healthcare

Easiest Second Languages To Learn

Highest Paying Countries For Software Engineers

Disclosure: None