Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those successful funds in these small-cap stocks. In the following paragraphs, we analyze Wintrust Financial Corp (NASDAQ:WTFC) from the perspective of those successful funds.

Wintrust Financial Corp (NASDAQ:WTFC) was included in the 13F portfolios of 15 funds from our database at the end of September and the stock registered a decrease in enthusiasm from smart money during the third quarter. At the end of this article we will also compare WTFC to other stocks including Healthcare Services Group, Inc. (NASDAQ:HCSG), Landstar System, Inc. (NASDAQ:LSTR), and Swift Transportation Co (NYSE:SWFT) to get a better sense of its popularity.

Follow Wintrust Financial Corp (NASDAQ:WTFC)

Follow Wintrust Financial Corp (NASDAQ:WTFC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

patpitchaya/Shutterstock.com

With all of this in mind, let’s go over the fresh action encompassing Wintrust Financial Corp (NASDAQ:WTFC).

What does the smart money think about Wintrust Financial Corp (NASDAQ:WTFC)?

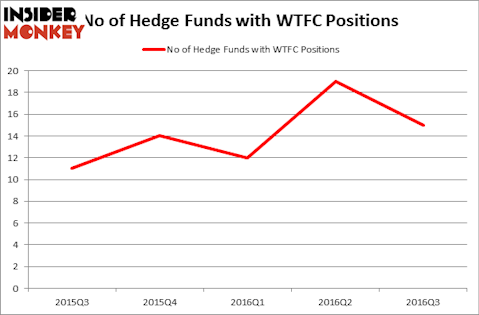

Heading into the fourth quarter of 2016, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in Wintrust Financial Corp, compared to 19 funds at the end of June. Below, you can check out the change in hedge fund sentiment towards WTFC over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Fisher of Fisher Asset Management holds the biggest position in Wintrust Financial Corp (NASDAQ:WTFC) which has a $73.8 million position in the stock. Sitting at the No. 2 spot is Millennium Management, one of the biggest hedge funds in the world, which holds a $55.4 million position. Some other peers that hold long positions include Ken Griffin’s Citadel Investment Group, Neil Chriss’ Hutchin Hill Capital, and Anand Parekh’s Alyeska Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Wintrust Financial Corp (NASDAQ:WTFC) has weathered a decline in interest from the aggregate hedge fund industry, it’s safe to say that there were a few hedge funds that decided to sell off their positions entirely last quarter. Interestingly, Matthew Lindenbaum’s Basswood Capital sold off the biggest investment of all the hedgies followed by Insider Monkey, totaling about $4.1 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund said goodbye to about $3.4 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Wintrust Financial Corp (NASDAQ:WTFC). These stocks are Healthcare Services Group, Inc. (NASDAQ:HCSG), Landstar System, Inc. (NASDAQ:LSTR), Swift Transportation Co (NYSE:SWFT), and Mentor Graphics Corp (NASDAQ:MENT). This group of stocks’ market values are similar to WTFC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HCSG | 8 | 23359 | 3 |

| LSTR | 17 | 179246 | 1 |

| SWFT | 30 | 452388 | 0 |

| MENT | 35 | 534307 | 4 |

As you can see these stocks had an average of 22 investors with long positions and the average amount invested in these stocks was $297 million, versus $232 million in WTFC’s case. Mentor Graphics Corp (NASDAQ:MENT) is the most popular stock in this table. On the other hand Healthcare Services Group, Inc. (NASDAQ:HCSG) is the least popular one with only eight bullish hedge fund positions. Wintrust Financial Corp (NASDAQ:WTFC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Mentor Graphics Corp (NASDAQ:MENT) might be a better candidate to consider taking a long position in.

Disclosure: None