Typically, the market doesn’t reward such companies, and you can find yourself waiting a long time for the market to come around to your view. On the other hand, if F5 Networks, Inc. (NASDAQ:FFIV) can get back to growth the upside potential is significant.

F5 shifts

The recent third-quarter results were a return to form for F5 Networks, Inc. (NASDAQ:FFIV):

Revenues of $370 million vs. internal guidance of $355 million to $365 million

Non-GAAP EPS of $1.12 vs. internal guidance of $1.06 to $1.09

Fourth quarter (Q4) revenue guidance of $378 million to $388 million

Q4 Non-GAAP EPS guidance of $1.17 to $1.20

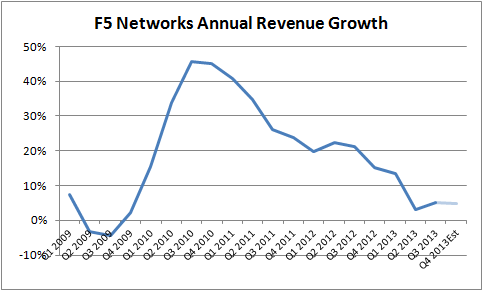

The stock appreciated sharply on the back of the revenue and earnings beat, but you need to look at the numbers in the context of long-term trends.

Source: F5 Networks accounts.

Growth is clearly slowing at F5 Networks, Inc. (NASDAQ:FFIV), and the guidance for Q4 isn’t particularly positive, either. With that said, Q3 was a significant improvement over F5’s nightmare in Q2. Essentially, its telco service provider revenues made a bit of a comeback.

Source: F5 Networks presentations.

F5 wasn’t the only company to report some weakness with spending from telco service providers in the spring. Other IT companies such as Fortinet reported a similar story. The good news is that some of the deals that slipped over from Q2 were closed in Q3. In addition, its U.S. enterprise revenues were surprisingly strong, particularly in an earnings season where tech bellwethers Oracle Corporation (NYSE:ORCL) and International Business Machines Corp. (NYSE:IBM) gave disappointing results.

Growth prospects?

The real question for investors: Can F5 Networks, Inc. (NASDAQ:FFIV) get out of its low-single-digit revenue-growth funk?

To do so, it must get product sales positive again. Representing 53% of total revenues, these sales declined 5% on the quarter, and are down 3.7% over the first three quarters. Indeed, on the conference call, F5’s management declared that generating product revenue growth would be its “No. 1 priority.” In the long term, its service revenues growth depends on getting more customers to install its products.

Moreover, there are other concerns with F5 Networks, Inc. (NASDAQ:FFIV):

The company has a dominant market share (over 50% according to most industry sources), so it will find it hard to grow by gaining market share from here.

Citrix Systems, Inc. (NASDAQ:CTXS) is growing its application delivery product NetScaler. Cisco Systems, Inc. (NASDAQ:CSCO) (which has discontinued investing in its ADC product) is recommending that its existing ADC customers integrate Netscaler.