It’s not us; it’s them

In 2012, U.S. nuclear power plant owners and operators purchased 59 million pounds of U3O8 equivalent, roughly the same amount as in 2003 and well below its 2006 demand peak of approximately 65 million.

Source: eia.gov

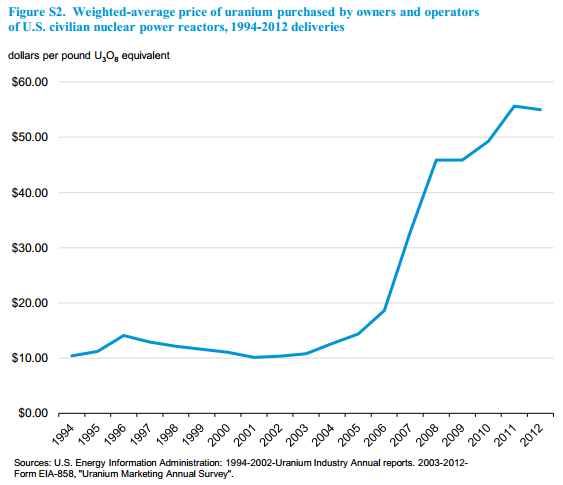

But over the same period, prices have skyrocketed. In 2011, 10 bucks would get you a pound of uranium. Now, the same pound costs power companies an average $54.99 per pound.

Source: eia.gov

Seventeen percent of uranium originates from within the U.S. and comes with a slightly higher $59.44 cost. The remaining 83% comes from foreign sources and costs $54.07 per pound.

With relatively steady demand in the U.S., the spike in uranium prices is out of our control, regardless of whether it results from increased demand abroad or reduced global supply. Either way, that makes U.S. power companies (and your dividend stocks) price takers, not price makers.

Utility costs

Companies like to keep costs and suppliers secret, but I found an easy approximation that begins with one company’s bragging rights. According to Exelon Corporation (NYSE:EXC), this nuclear-centric power company‘s 19,000 MW nuclear fleet produces 20% of our nation’s nuclear energy.

Working my way back from these two numbers and newly released national statistics, I calculated uranium costs for four of nuclear’s heaviest hitters, and the results were fascinating.

| Company | Nuclear Generation (% Total) | Nuclear Generation (MW) | Total Uranium Cost ($M) |

|---|---|---|---|

| Exelon | 55% | 19,100 | $638 |

| Duke | 17% | 8,450 | $282 |

| Southern Company | 16% | 6,970 | $233 |

| FirstEnergy | 20% | 3,990 | $133 |

Author’s approximations. Sources: investor-relations websites, SEC filings, eia.gov.

Exelon Corporation (NYSE:EXC) spent around $638 million on uranium in 2012, more than double Duke Energy Corp (NYSE:DUK)‘s $282 million. Each uranium outlay is directly related to nuclear capacity, so it makes sense that Exelon Corporation (NYSE:EXC)’s expenses would be highest, while FirstEnergy Corp. (NYSE:FE)‘s $133 million puts it lowest.

For a pinch of perspective, I also compared uranium costs with each utility’s 2012 net profit. While earnings aren’t the most reliable metric to judge long-term capital-intensive companies like utilities, it gives us an idea how expenditures added up last year.

| Company | 2012 Net Profit ($M) | Uranium-to-Earnings Ratio (%) |

|---|---|---|

| Exelon | $1,160 | 55% |

| Duke | $1,768 | 16% |

| Southern Company | $2,415 | 10% |

| FirstEnergy | $770 | 17% |

Author’s approximations. Sources: investor-relations websites, SEC filings, eia.gov.

Exelon Corporation (NYSE:EXC) dished out 55% of its earnings in uranium expenses, while The Southern Company (NYSE:SO) sacrificed just 10% of its $2.4 billion in net profit. FirstEnergy Corp. (NYSE:FE) followed with a 17% payout, while Duke Energy Corp (NYSE:DUK) doled out 16%.

But while costs today mean something to investors, costs tomorrow are what really matter. If Uranium’s 400% increase keeps up over the next decade, Exelon’s prices will mushroom accordingly. And even though The Southern Company (NYSE:SO) currently spends more on the magic molecule than FirstEnergy Corp. (NYSE:FE), its 16% capacity reliance gives it the most protection from volatile prices.

The end of nuclear?

Luckily for investors, there’s more to power pricing than meets the eye. As an example, Exelon Corporation (NYSE:EXC) currently contracts with three suppliers for guaranteed supply requirements through 2016. Its enrichment agreements have the company set through 2017, fuel fabrication through 2018, and conversion services through 2020.

And while uranium hedging isn’t common practice today, markets have a way of creating themselves for vital goods with volatile prices. Recent natural gas price increases pushed many utilities to take one-time hits for bad hedges, but the companies kept plants powering through thick and thin.

Uranium was a $3.2 billion market in 2012 — and it could easily hit $15 billion in the next decade. Energy diversity is never a bad thing, and nuclear-centric companies like Exelon Corporation (NYSE:EXC) have worked around the kryptonite conundrum by sourcing from multiple suppliers. For now, at least, uranium spending is cost that remains relatively under control.

The article Will Uranium Costs Kill Nuclear? originally appeared on Fool.com and is written by Justin Loiseau.

Motley Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends Exelon and Southern.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.