Joel Greenblatt is the founder of Gotham Capital, a hedge fund with extremely good returns. We at Insider Monkey like Joel Greenblatt because he’s smart and not so secretive about his investment style. He’s authored two books, “You Can Be A Stock Market Genius” and “The Little Book That Beats the Market.” In the “The Little Book That Beats The Market,” Greenblatt describes a quantitative strategy –which he calls the ‘magic formula’- to pick stocks. It’s actually a very simple quantitative stock ranking scheme. It uses return on capital and earnings yield as inputs. Return on capital is the metric that shows whether a business is a good one or not. Earnings yield is the metric that shows whether a company is cheap or not. Greenblatt suggests using these measures to identify good but cheap businesses, and buy them. That’s the secret behind the ‘magic formula’. In “The Little Book That Beats The Market,” Greenblatt calculated hypothetical returns for the 1988-2004 period. The magic formula returned an average 30.8% per year, while the market return was 12.3% and the S&P 500 returned an average 12.4%. So this formula beats the market by 18% per year. Seems too good to be true…

Magic formula investing has a dedicated website where also calculated are the hypothetical returns between 1999 and 2009. During these 10 years magic formula investing hypothetically returned a cumulative 289% whereas the S&P 500’s cumulative return was -1.5%. The site offers professionally managed accounts for interested investors who want to follow this strategy and beat index funds. Insider Monkey, your source for free insider trading data, contacted Formula Investing management and requested monthly hypothetical returns going back 10 years. The company turned down our request. Here’s what the site’s publicist had to say:

“Magic Formula Investing’s professionally managed accounts have 24 top stocks that have a minimum market cap of $1.164 billion. They rebalance the portfolio every quarter after the inception date based on the latest top-ranked stocks. This results in short term tax consequences within the first year. After the initial 12 months, they manage for long term tax efficiency by selling losses prior to the one year holding period, and selling gains soon after the one year holding period, as described in “The Little Book That Beats the Market”.”

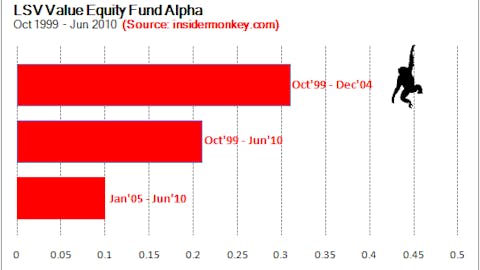

But the site has actual returns of the strategy (after fees and expenses) since May 2009. We at Insider Monkey decided to test out the claim of magic formula investing beating the market by 18% per year. We wonder specifically about double digit abnormal returns. We used Fama-French’s three factor model to calculate abnormal returns. We have returns for only 14 months, so these results may not be indicative of true performance of the strategy. Nevertheless, this is all we have to go on for now. Our regression results show that this strategy has a beta of 1.05. It has a slight tilt towards smaller firms (blue chips stocks usually don’t sell at cheap prices) but interestingly, no value tilt. The monthly alpha of the strategy is 37 basis points. After expenses Joel Greenblatt’s magic formula strategy generates 4.5% annual alpha. It doesn’t beat the index funds by 18% per year and generate Warren Buffett like returns, but the excess return is still more than 5% per year. This is better than Eugene Fama’s DFA Small Cap Value Fund. It is also better than Lakonishok’s LSV Value Equity Fund. Apparently hedge fund managers are better investors than are star university professors.