World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

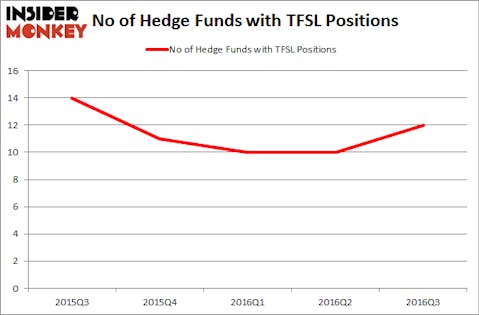

TFS Financial Corporation (NASDAQ:TFSL) investors should pay attention to an increase in hedge fund sentiment of late. TFSL was in 12 hedge funds’ portfolios at the end of the third quarter of 2016. There were 10 hedge funds in our database with TFSL holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as NewMarket Corporation (NYSE:NEU), H&R Block, Inc. (NYSE:HRB), and Nutanix Inc. (NASDAQ:NTNX) to gather more data points.

Follow Tfs Financial Corp (NASDAQ:TFSL)

Follow Tfs Financial Corp (NASDAQ:TFSL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wrangler/Shutterstock.com

What does the smart money think about TFS Financial Corporation (NASDAQ:TFSL)?

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a gain of 20% from the previous quarter. On the other hand, there were a total of 11 hedge funds with a bullish position in TFSL at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the most valuable position in TFS Financial Corporation (NASDAQ:TFSL). Renaissance Technologies has a $101 million position in the stock. On Renaissance Technologies’s heels is Michael A. Price and Amos Meron of Empyrean Capital Partners, with a $41.2 million position; 2.1% of its 13F portfolio is allocated to the stock. Other professional money managers that are bullish contain Emanuel J. Friedman’s EJF Capital, Israel Englander’s Millennium Management and Cliff Asness’ AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key money managers have jumped into TFS Financial Corporation (NASDAQ:TFSL) headfirst. Highbridge Capital Management, led by Glenn Russell Dubin, initiated the biggest position in TFS Financial Corporation (NASDAQ:TFSL). Highbridge Capital Management had $0.7 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Matthew Hulsizer’s PEAK6 Capital Management.

Let’s also examine hedge fund activity in other stocks similar to TFS Financial Corporation (NASDAQ:TFSL). These stocks are NewMarket Corporation (NYSE:NEU), H&R Block, Inc. (NYSE:HRB), Nutanix Inc. (NASDAQ:NTNX), and Israel Chemicals Ltd. (NYSE:ICL). All of these stocks’ market caps match TFSL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEU | 14 | 103518 | 3 |

| HRB | 13 | 153650 | -7 |

| NTNX | 35 | 89334 | 35 |

| ICL | 4 | 3555 | 1 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $88 million. That figure was $162 million in TFSL’s case. Nutanix Inc. (NASDAQ:NTNX) is the most popular stock in this table. On the other hand Israel Chemicals Ltd. (NYSE:ICL) is the least popular one with only 4 bullish hedge fund positions. TFS Financial Corporation (NASDAQ:TFSL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard NTNX might be a better candidate to consider taking a long position in.

Disclosure: None