Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Charter Communications, Inc. (NASDAQ:CHTR).

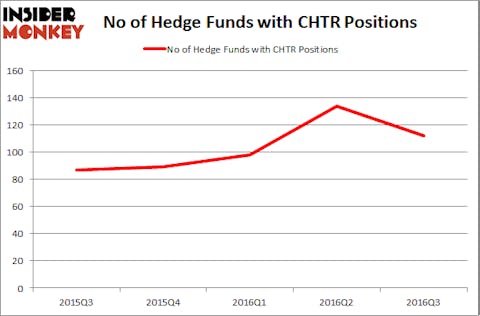

Charter Communications, Inc. (NASDAQ:CHTR) was included in the portfolios of 112 funds tracked by us at the end of the third quarter of 2016. However, CHTR has seen a decrease in hedge fund interest in recent months as there had been 134 hedge funds in our database with CHTR holdings at the end of the previous quarter. At the end of this article we will also compare CHTR to other stocks including AutoZone, Inc. (NYSE:AZO), Telefonica Brasil SA (ADR) (NYSE:VIV), and Electronic Arts Inc. (NASDAQ:EA) to get a better sense of its popularity.

Follow Charter Communications Inc (NASDAQ:CHTR)

Follow Charter Communications Inc (NASDAQ:CHTR)

Receive real-time insider trading and news alerts

To most stock holders, hedge funds are viewed as slow, old investment vehicles of the past. While there are more than 8,000 funds trading at the moment, Our researchers look at the leaders of this group, around 700 funds. Most estimates calculate that this group of people orchestrate bulk of all hedge funds’ total capital, and by keeping an eye on their matchless stock picks, Insider Monkey has unearthed a few investment strategies that have historically exceeded the market. Insider Monkey’s small-cap hedge fund strategy outperformed the S&P 500 index by 12 percentage points per year for a decade in their back tests.

HodagMedia / Shutterstock.com

With all of this in mind, let’s analyze the key action regarding Charter Communications, Inc. (NASDAQ:CHTR).

How have hedgies been trading Charter Communications, Inc. (NASDAQ:CHTR)?

At Q3’s end, a total of 112 of the hedge funds tracked by Insider Monkey were bullish on this stock, a decline of 16% from the second quarter of 2016. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the largest position in Charter Communications, Inc. (NASDAQ:CHTR), worth close to $2.5495 billion, accounting for 2% of its total 13F portfolio. Sitting at the No. 2 spot is Lone Pine Capital, led by Stephen Mandel, holding a $1.4174 billion position; 6.3% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish contain Eric W. Mandelblatt’s Soroban Capital Partners, John Armitage’s Egerton Capital Limited and William B. Gray’s Orbis Investment Management.