The UN estimates that, by 2050, the global population will have increased by 47% to 9 billion. While we don’t think often about population growth in investment analysis, this will predictably drive fertilizer consumption. And between just 2012 and 2016, fertilizer consumption will increase by 20%, according to The International Fertilizer Association. So the question then turns to how companies will get a greater share of this growing market.

Mosaic Co (NYSE:MOS)’s Beat Indicates Industry Upswing

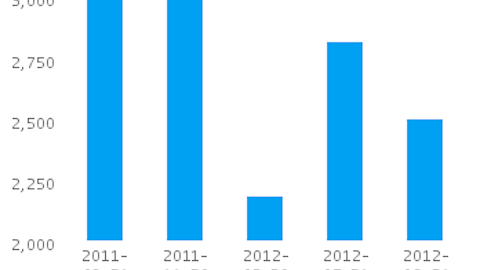

The Mosaic Company is a Minnesota chemical company that creates crop fertilizers–phosphate and potash. In the most recent quarter, earnings from potash and phosphate fell to $2.54 billion (-16%) and $560 million (-30%), respectively. Problems in China and India resulted in lower sales of potash (a 0.3 million ton drop to 1.5 million tons). But investors were right to look at the overall picture in reacting to the news: income per share was $1.47–still much higher than the $0.88 expected by analysts.

Potash Corp./Saskatchewan (USA) (NYSE:POT) M&A Strategy, Market Leadership Shine

As a Motley Fool contributor rightly noted some days ago, Potash is in a strong position to capitalize off of its global leadership in potash production. Its size and reputation poses a strong barrier to entry for many would-be entrants. Like Mosaic, it too has offered China a highly discounted rate for potash. This could help cut back on the potash surplus and help boost prices in the long-term as demand increases in China and India.

But where it stands out from Mosaic is in its ability to pursue more accretive takeover activity. Potash Corp (NYSE:POT) is now in talks with Israel to increase its share in the Israel Chemicals Ltd. The Israeli company is a huge employer of the Negev area, which extracts minerals from places near the Dead Sea to produce fertilizer and potash. Acquisition deals were started in October, and a decision will be made at the end of January 2013. Potash’s move to acquire the Israeli company will strengthen its lead to 25% of total yearly global production. Now that the January 22 elections are over, there is less political risk of elected officials backing a takeover. In the elections, Netanyahu’s right-leaning Likud party won seats, so a deal (or at least a compromise) is more likely to backed.

And certainly, the company needs the momentum. Potash announced a 36 week shutdown across several potash mines, which is estimated to result in 13% less production and income (1.6 million tons) than the same time last year. The forecast for 2013 and 2014 EPS is for $3.20 and $3.05, respectively.

Conclusion

I believe much of the upside from an Israel Chemicals takeover has already been factored into Potash’s stock price. I actually don’t expect the company to get much of what it expects, since Israeli politicians have generally been pointed about a takeover’s impact on the Negev economy. So, if anything, there is some downside at this point. Moreover, Potash trades at a respective 16.4x and 13.7x past and forward earnings. By contrast, Mosaic trades at corresponding figures of 14.7x and 12.5x and is even forecasted for around a 200 bps greater growth rate at 7.6%. I recommend therefore buying shares of Mosaic to profit off of an equilibration in the multiples.

The article Can Mosaic, Potash Outperform in Current Environment? originally appeared on Fool.com and is written by David Gould.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.