The A class shares of rock star investor Warren Buffett’s vehicle Berkshire Hathaway Inc. (NYSE:BRK.A) reached a 52-week high on Friday. Let’s take a look at how it got here to find out if the famed company’s stock price can grow even higher.

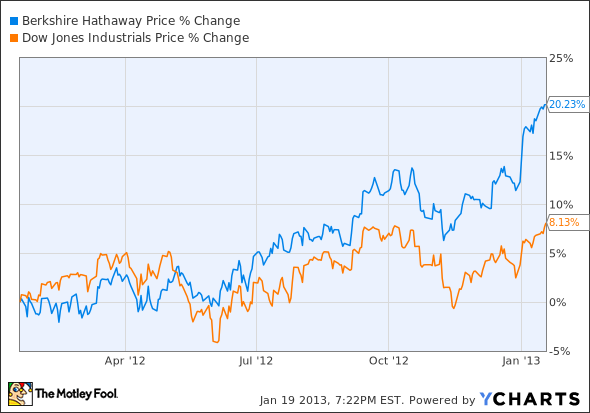

How it got here Buffett is celebrated and followed because he regularly beats the market. So it stands to reason that when the Dow advances, Berkshire Hathaway’s stock price not only gains too, it trumps the index. Take any time frame you’d like — Buffet’s child will almost always win handily against the DJIA. That applies to the short term, let’s say the past three months:

Data by YCharts.

A slightly longer string of time, one year:

Data by YCharts.

Or even a full decade:

Data by YCharts.

Buffett, an eminently quotable guy, has been making his usual pronouncements and prognostications of late, but he hasn’t said or revealed anything jolting enough to move the stock on its own. Rather, the stock price advance seems largely to be due, like the success of the firm it constitutes, to strong improvement in fundamentals over time.

Berkshire Hathaway earnings saw marked gains in 3Q, the company’s most recent reporting period. Net came in at $3.9 billion, a fat 72% advance over the same time frame the previous year. Zooming out by a factor of three, the same figure for 1Q-3Q last year was a little over $10 billion, or 43% better than the same period of 2011.

These were on the back of across-the-board revenue growth in each of the firm’s three business lines. The heart of the company is its insurance and related operations, and these beat loudly with a 15% year-on-year advance in the most recent quarter. Railroad, utilities, and energy chugged and beamed along well, growing 8%, and the take from finance was positive that quarter, at a little over $1 billion… as opposed to the $1.45 billion shortfall posted in 3Q 2011.

Banking on profits With large-scale banks weighing in with results recently, Buffett has been hit by the spotlight, too. In mid-2011, Berkshire Hathaway took a $5 billion stake in Bank of America Corp (NYSE:BAC) . This was a classic contrarian move by the cagey investor, made at a time when the company was still flat in the mud, trying to wash away the grime of the crisis era.

As so often happens, his timing was magnificent, and he got a sweet deal. On the day the buy was announced, B of A’s stock price was a soggy $7.55. Now, even after the bank’s market-displeasing results last week, they still trade at a nearly 50% premium.

Smart Warren holds preferred shares that carry a rich 6% dividend. What’s more, the buyer will probably be B of A itself — after all, what respectable bank drawing a few percentage points on its long-term debt wants to keep forking over that high a disbursement? B of A will pay a 5% fee for the privilege of retiring those preferreds, or a cool $250 million.