Apple Inc. (NASDAQ:AAPL) is Blue Ridge Capital’s top stock pick. John Griffin launched Blue Ridge in 1996 and was one of the best performing hedge funds in 2007; Griffin notched a 65% return that year. The manager is a protégé of Julian Robertson’s Tiger Management and runs a similar investment style as other Tiger cubs – a long/short equity strategy with a bias toward the former. After reviewing Blue Ridge’s latest 13F, we have identified the fund’s top five stocks.

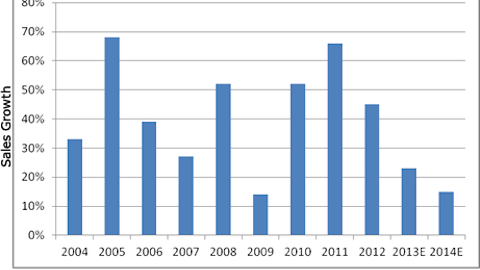

Apple is one of the best ‘growth at a reasonable price’ opportunities in Blue Ridge’s portfolio, and also makes up 6.9% of its total 13F holdings. The tech company has a mere 0.6 PEG after coupling its 12x earnings valuation and 21% expected long-term EPS growth rate. Sales growth is expected to come in at 25% in FY2013 after a 45% increase in FY2012, on the back of upgrades to the company’s smartphone, tablet, and laptop. There’s also a decent possibility that we’ll see an Apple TV and a low-cost iPhone released over the next year or two.

Apple’s total cash hoard ($120 billion) and superb free cash flow position means that there’s a possibility of a dividend boost in 2013 as well. Apple Inc. (NASDAQ:AAPL) calls a number of billionaires as shareholders, including Ken Fisher, Ken Griffin and David Einhorn (check out David Einhorn’s top picks).

Google Inc (NASDAQ:GOOG), meanwhile, is Blue Ridge’s second largest pick and makes up 6.2% of the fund’s 13F. The tech company is expected to see revenues up 38% by the end of this year, and 16% in 2013. The Motorola Mobility acquisition has put recent pressures on earnings, but improvement is expected in 2013 following restructuring efforts, and the possibility of an “X Phone” release (see more details on the new Google-Motorola smartphone). Google also has a solid valuation, trading at a forward P/E (15x) well below its trailing P/E (22x), and the industry average (24.1X).

Amazon.com, Inc. (NASDAQ:AMZN) is the third largest Blue Ridge holding, making up 5.8% of the fund’s 13F. Analysts predict that revenues will be up 28% in 2013 on the back of 29% growth in 2012. These robust sales estimates have helped the stock appreciate close to 50% year to date.

The e-commerce company is growing off strong market share infringement on traditional retailers and penetration of other markets, including tablets. We like Amazon’s business model potential and long-term expected EPS growth rate of 33%, well above Apple Inc. (NASDAQ:AAPL)’s 21%, in annual terms. Only billionaire Ken Fisher of Fisher Asset Management owned more shares than Blue Ridge in 3Q among the hedge funds we track (check out Ken Fisher’s newest picks).

What are Griffin’s No. 4 and 5 picks in his 13F portfolio?