Although the PC has been getting a lot of media attention, it hasn’t been the feel-good kind of attention that leaves you with a sense of optimism. Thanks to the rise of mobile computing — namely, smartphones and tablets — the PC appears to be showing signs of maturation, which could indicate the onset of ultimate PC death. Well, that’s a little extreme, but in all seriousness, the PC is under siege by the disruptive forces of mobile computing. To date, the evidence suggests that we’re probably a long way off from this doomsday scenario. However, there’s no way for this data to predict what a precipitous decline in smartphone and tablet prices would do to the PC.

The thinking here is that the cheaper mobile computing devices become, the less attractive PCs are in comparison. It’s entirely possible this dynamic could lead to a scenario where consumers prolong their PC replacement cycles. Should consumers largely shift from a four-year replacement cycle to a five-year cycle, it would be the equivalent of shrinking the PC industry by 20%. Have we reached this tipping point in this whole “PC is dead” argument?

Priced to sell

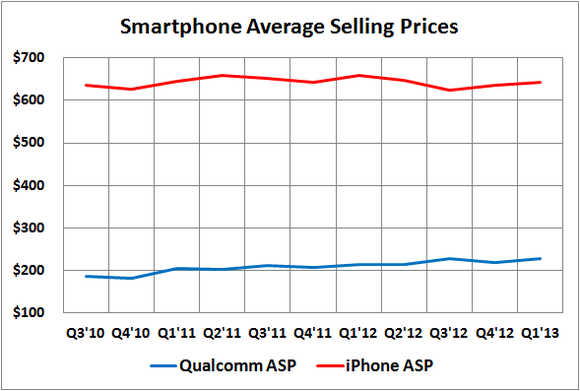

Source: Apple and QUALCOMM, Inc. (NASDAQ:QCOM) quarterly earnings press releases and supplemental data. Based on fiscal year results.

Thanks to carrier subsidies, smartphone ASPs have remained stable. Without subsidies, it would be hard to believe that Apple Inc. (NASDAQ:AAPL) could sell nearly 136 million iPhones last year for over $180 more than the average selling price a PC in 2012. The key takeaway here is that carrier subsidies helped drive higher rates of smartphone adoption, not to mention the added protection it provides to smartphone manufacturers against industry-wide pricing wars. Not only has this been a blessing for Apple Inc. (NASDAQ:AAPL)’s very expensive smartphone, it’s also great news for QUALCOMM, Inc. (NASDAQ:QCOM), which earns royalties based on smartphone average selling prices. Unfortunately, the same can’t be said about tablets, which largely remain unsubsidized.

Source: AppleApple Inc. (NASDAQ:AAPL) quarterly earnings press releases. Units in thousands. Based on fiscal year results.

Clearly, the 7-8 inch tablet segment is changing everything for all parties involved. Running a quick search on Best Buy Co., Inc. (NYSE:BBY)‘s website makes it painfully obvious that Google Inc (NASDAQ:GOOG) Android tablets are dominating and influencing the entire tablet market. With over 50 Android tablets to choose from with a price less than $200, the tablet market is undergoing a transformation in a race-to-the-bottom kind of way. According to NPD, excluding the Amazon.com, Inc. (NASDAQ:AMZN) Kindle line, the average Android tablet sold for $151 in 2012 — $68 less than it did in 2011.

This low barrier of entry has led IDC to forecast that Android is on track to become the world’s most popular tablet ecosystem this year. Despite potential increases in volume, price declines will ultimately hurt manufacturer and retailer profit margins.

A zero-sum game

Even in the best years, worldwide consumer electronics spending is often a slow, single-digit growth industry. Last year, consumers allocated fewer dollars towards electronic purchases while shifting more of their remaining dollars towards smartphones and tablets. However, this softness hasn’t stopped the smartphone and tablet market, which is expected to account for 40% of worldwide consumer electronic spending in 2013. In terms of an addressable market, tablets and smartphones will represent a $400 billion opportunity in 2013, whereas the PC laptop market will represent a $92 billion opportunity worldwide. In other words, the smartphone and tablet industries have a far greater reach than the PC market could ever imagine.

The sort-of-silver lining

Although aggregate consumer electronic spending is for the most part a zero-sum game, the total number of Internet-connected devices continues to climb. According to NPD, U.S. households now own a combined 500 million Internet-connected devices, which breaks down to an average of 5.7 per household. This average represents a 0.4% increase from three months ago, largely driven by robust demand for smartphones and tablets. Companies like Google Inc (NASDAQ:GOOG) are in an excellent position to benefit greatly from increased internet usage, but the rest of the story isn’t as clear.

In emerging markets, where smartphones tend to be unsubsidized, adoption rates are largely correlated to the average selling price of devices. It’s expected that the smartphone will play a central role in how the majority of the next 2 billion Internet users will experience the Internet for the first time. The prospect of the $100 smartphone will act as a great enabler to increase adoption rates across the world. In this context, it’s highly probable these users weren’t in the market for a PC in the first place.

Affordable prices coupled with less overall saturation are great reasons why tablets and smartphones will continue to be adopted at a higher rate than PCs, but will it be enough to prolong the PC replacement cycle? At this time, it’s still too early to say, especially since the PC market is poised to evolve in the coming years.

The article Will Falling Smartphone and Tablet Prices Hurt the PC? originally appeared on Fool.com and is written by Steve Heller.

Fool contributor Steve Heller owns shares of Apple, Qualcomm, and Google. The Motley Fool recommends Amazon.com, Apple, and Google. The Motley Fool owns shares of Amazon.com, Apple, Google, and Qualcomm.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.