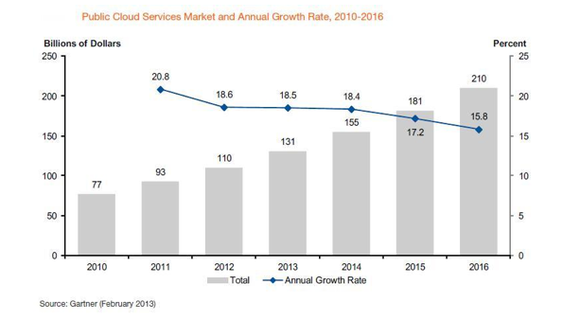

Gartner thinks that global spending on public cloud services will achieve a CAGR of over 17% from 2011 to 2016. The market is also expected to be worth over $200 billion by 2016. So who will this benefit the most?

The leader is not leading in profits…

The current leader of the public cloud market is Amazon.com, Inc. (NASDAQ:AMZN) . Amazon Web Services (AWS) is expected to double the amount of revenues it brings in this year, while also accounting for 5% of the company’s sales as well, according to analysts. Some analysts have gone so far as to state that AWS would be worth over $20 billion as a standalone company, or close to a fifth of the company’s overall stock value. Amazon has a huge head start ahead of cloud competitors Microsoft Corporation (NASDAQ:MSFT) and Google Inc (NASDAQ:GOOG), who came to the party late. So what’s the problem?

The problem here is that Amazon already has tiny margins at only 1.11% for 2012, as compared to over 25% for Google and Microsoft. Bloomberg author Ari Levy sees this as a positive, writing that “Amazon can cut prices on cloud services without affecting its total profitability” and “Investors aren’t fazed by Amazon’s low margins.” This may certainly be true as of now, but how long will investors wait for the company to turn a profit from all of its revenues coming in? With negative EPS, Amazon won’t be able to drag down prices forever simply in the name of expansion.

In the meantime,Microsoft Corporation (NASDAQ:MSFT) and Google Inc (NASDAQ:GOOG)risk seeing margins attributed to cloud services being sucked down the drain in an increasing price war against Amazon– as well as each other. After Google insinuated that their services could be up to 50% cheaper than the competitions, one of the main individuals in charge of running AWS, Adam Selipsky, stated that (in reference to a price war):

“We’ve always been very good at making everything as low-cost as possible… then we lower it some more.”

Amazon’s strategy seems stuck in place. Google doesn’t seem to be worried. Microsoft Corporation (NASDAQ:MSFT), whose Azure platform was launched ahead of Google Inc (NASDAQ:GOOG)’s cloud platform, was launched to retain enterprise customers and tie in its ecosystem. The battle of ecosystems is being fought within the cloud price war- with public cloud services being the main glue to hold all of the weapons together, so all three companies are upping their cloud game to host things such as video and lure customers to products such as Google Docs and Windows 365. Even if it pays off in the end, the cost of war is always great.

Why not invest in one of the arms dealers?

While the big boys are duking it out, the small-cap QLogic Corporation (NASDAQ:QLGC) is quietly poised to continue to profit from the cloud computing revolution– no matter who is leading in public cloud services. According to the company’s website:

QLogic Corporation (NASDAQ:QLGC) is a global leader and technology innovator in high performance networking, delivering adapters, switches, routers and ASICs that power today’s data, storage and server networks for leading Global 2000 corporations. The company delivers a broad range and diverse portfolio of networking products that include Converged Network Adapters for the emerging Fibre Channel over Ethernet (FCoE) market, Ethernet adapters, Fibre Channel adapters and switches, iSCSI adapters, and routers.

As Cloud computing ramps up, QLogic Corporation (NASDAQ:QLGC) is poised to benefit from the increasing need for the products it offers. Not only that, the company is attractively valued now. The company trades at a lowly P/E of only about 6, with a share price gravitating towards the lower part of its 52 week range. Looking a little closer, the company appears to be extremely strong with a rock-solid balance sheet: