Hedge fund managers become billionaires by collecting huge fees on moderately good performance. What percentage of hedge fund profits are pocketed by hedge fund managers? Reuters published an article yesterday with the following title: “Managers Pocket 28 Percent of Hedge Fund Profits-Study”. That’s a very misleading title. First of all, the answer is not a constant value. It is a function of returns. When returns are higher hedge fund managers capture a smaller percentage of profits and when returns are lower hedge fund managers pocket a larger percentage of profits because of their flat management fees. Hedge fund managers also pocket more than 100% of profits when their returns are negative, like in 2011.

Let’s get into the details of the “study” that is commissioned by “Alternative Investment Management Association” and KPMG. Alternative Investment Management Association is the global lobbying organization on behalf of hedge funds. When they do research, they will try to cherry pick their data points to make hedge funds look as good as possible. If their research yield really unfavorable results for their constituents, they may even decide not to publish the results. That’s why the “research” pushed out by this lobby group should be approached with caution. However, this doesn’t mean their research is always biased. A closer look at the Reuters article is required:

“Hedge fund managers pocketed 28.1 percent of profits generated by their funds over the past 18 years, new research from London’s Imperial College found. The research, commissioned by KPMG and hedge fund industry body the Alternative Investment Management Association, found investors’ share of annual profits delivered by hedge funds from 1994-2011 was 71.9 percent. It also found funds delivered an average annual return of 9.07 percent from 1994-2011, compared with 7.27 percent from global commodities, 7.18 percent from stocks, and 6.25 percent from global bonds.

…The study, which assumed average hedge fund fees of 1.75 percent and performance fees of 17.5 percent, followed the publication in January of ‘The Hedge Fund Mirage’ by fund manager Simon Lack.”

We weren’t satisfied with Reuters’ report. They just summarized the summary of the research. So I found the original report titled “The Value of the Hedge Fund Industry to Investors, Markets and the Broader Economy“. It can be downloaded at KPMG’s website. Here are some numbers and additional information from the study:

1. Hedge funds generated an annual alpha of 4.19% between 1994 and 2011.

2. Using sophisticated econometric approaches, Jagannathan, Malakhov and Novikov (2010), and Kosowski, Naik and Teo (2007) show that the abnormal performance of the top decile of hedge funds persists even at annual horizons.

3. Aggregate level hedge fund annualized gross returns are 12.61 percent, of which 9.07 percent is the investors’ share, whereas hedge fund managers get 3.54 percent of returns.

4. The study used equal weighted Hedge Fund Research (HFR) hedge fund database. Survivorship bias however is not a factor in the data because both active and inactive funds are included.

5. Self-selection bias may arise if a larger proportion of good or badperforming hedge funds systemically avoid reporting to commercial databases. A recent study by Edelmann, Fung and Hsieh (2011) shows that self-selection bias is negligible in commercial hedge fund databases.

6. Hedge funds generate 4.13% annual alpha when the economy isn’t in a recession. The annual alpha drops to 2.28% during recessions.

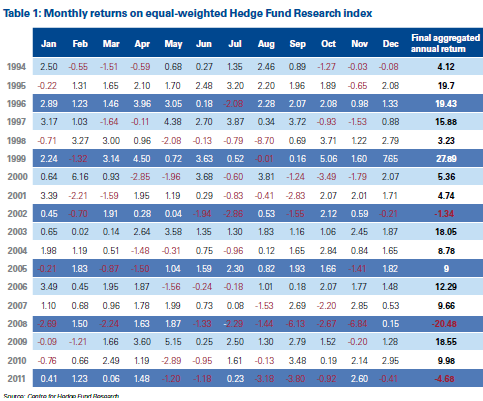

Overall the data used in this study looks good. What they report also seems accurate. Unfortunately, what the study didn’t report are the results for the first half of the 18 year period and the second half of the 18 year period. It’s not our impression that this didn’t cross their mind. We think the omission was purposeful. Hedge funds certainly had alpha in the past, but do they still have an edge after eclipsing $2 trillion in assets? How did they perform over the last 5 years? This isn’t a huge problem though. They published monthly hedge fund returns in their study. We can extract the data from the pdf file and calculate hedge funds’ alpha during the past 5, 10, 15 year periods. We wonder if Reuters would be open to publishing our results with the same enthusiasm. But then, we’re not lobbyists. We’re researchers and analysts. Here are the returns from the study:

It is always good to double check someone else’s returns. You never know what you’ll uncover.

So that you can check our work, we’ll tell you what we did. We used Carhart’s four factor model to calculate alphas in this analysis. Fama French factors as well as the momentum factor are downloaded from Kenneth French’s website. Initially we used the entire 18 year period to calculate hedge funds’ alpha. Our regression results showed that hedge funds’ monthly alpha was 30 basis points. This about 3.71% annually between 1994 and 2011. This is nearly half a percentage point lower than the London Imperial College’s study but in the same ball park. Hedge funds were indeed able to generate alpha over the last 18 years (The annual alpha increases to 3.96% if we used simple CAPM to calculate alpha, not a materially different result).

Next we calculated hedge funds’ alpha between 1994 and 1999. Hedge funds’ monthly alpha in the first 6 years was 43 basis points. The annual figure is 5.30%. As expected hedge funds generated a larger alpha in the earlier years of the industry when there is little competition.

Next we calculated hedge funds’ alpha between 2000 and 2005. Hedge funds’ monthly alpha between 2000 and 2005 was 28 basis points. The corresponding annual alpha is 3.42%.

Next we calculated hedge funds’ alpha between 2006 and 2011. Hedge funds’ monthly alpha over these 6 years was slightly above 28 basis points. The corresponding annual alpha is 3.47%.

Finally we calculated hedge funds’ alpha between 2009 and 2011 to estimate the industry’s latest alpha. Surprisingly hedge funds still generated 24 basis points in monthly alpha or 2.89% in annual alpha.

This is a more appropriate number to use when discussing hedge funds. Hedge funds can still generate positive alpha after fees. This means that their investors benefited over the last three years by sticking with hedge funds. Investors should know that being able to generate alpha isn’t the same thing as beating the S&P 500 index. Hedge funds had a beta of 0.24 in our 2009-2011 regression. This means that when the market goes up by 10%, they would return only 2.4% if their alpha is zero. Since their alpha is 2.9% hedge funds will return 5.3% when the market goes up by 10% and will gain only 0.5% when the market is down 10%. Unfortunately, most people don’t understand the concept of alpha (read how to calculate alpha and beta).

Over the latest 3 years hedge funds returned 26% according to HFR hedge fund database. This is after fees. If we assume 1.75% flat fee and 17.5% performance fee, then hedge funds’ total return (before fees) comes up to 36.77%. This means that hedge fund managers pocketed 29.3% of total profits over the last 3 years. However, this would be a very biased estimate because the stock market had enourmous returns over the last 3 years. Here is another biased estimate. Between 2008 and 2011 hedge funds returned a total of 2.03%. Before fees, hedge funds generated a total return of 9.45%, which means that over the last 4 years hedge fund managers pocketed 79% of total profits and their clients got only 21%.

Let’s expand the calculation to the latest 5 years. Since the beginning of 2007 hedge funds returned 12.2% after fees and 23.5% before fees, which means that over the latest 5 years hedge fund managers pocketed 48% of total profits and their clients got 52%.

So, back to the title of the article. What percentage of hedge fund profits are pocketed by hedge fund managers? As you can see, it depends on the time period. However, one thing is clear. The lower bound is around 30% and the upper bound is 80%. Assuming that the market returns 10% annually and hedge funds return 5.3% annually (based on hedge funds’ most recent alpha and beta estimates), hedge fund managers will pocket 35% of total profits.

Do investors really have to pay 35% of their profits as fees to turn hedge fund managers into billionaires or do they have a better option? Our research has shown that it is possible to generate double digit alpha by imitating the most promising stock picks of hedge fund managers. The best part of this news is that you don’t have to pay a single dime to hedge fund managers to do this. Read the details here.