After we were contacted by an uninformed reader regarding our last post, Insider Monkey realized there are investors out there who don’t understand how to calculate alpha and beta. After doing some research, we’re left with a startling statistic: Mutual fund investors in America will overpay an estimated $18-$38 billions in excessive expenses this year.

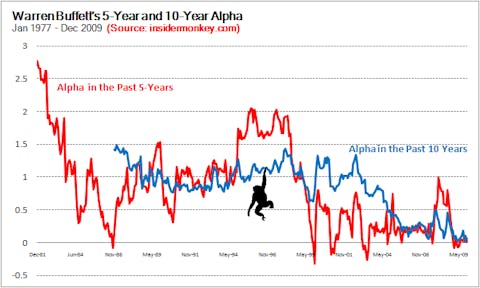

The average mutual fund expense ratio in this country is about 0.85%. Insider Monkey recently published an article about Warren Buffett’s disappearing alpha and received several uninformed comments from Warren Buffett fans. It’s obvious that a majority of investors don’t know what alpha or beta are, and consequently overpay their fund managers for beta that can be generated cheaply elsewhere. The idea of $38,000,000,000.00 going every year to incompetent portfolio managers – ugh – and I feel guilty ordering a soda at my local deli.

Here are a few tips to help one identify alpha and beta. Beta first.

1. Market beta: This beta measures a fund manager’s exposure to the fluctuations in the general market. If a portfolio’s returns closely follow the movements of general market returns, then this portfolio’s beta is close to 1. Most mutual funds out there are like this; they’re called closet index funds. They probably charge anywhere between 0.5% to 2% in expenses. Do not invest in these funds. You can buy Vanguard’s or Fidelity’s index funds and pay only 0.1% in expenses. For a $10,000 investment, that would save you anywhere from $40 to $190 in the first year alone.

2. Size beta: This beta measures a fund manager’s exposure to small capitalization stocks. Historically, small cap stocks performed better than large cap stocks. Most academicians think that small cap stocks are more risky and that’s why they have higher returns. It doesn’t matter whether or not you agree with this theory. You should take into account this size effect when evaluating your fund manager’s performance. If he (and let’s face it, it’s probably a ‘he’) achieves high returns simply by investing in small cap stocks, don’t reward him by paying excess fees for this. Trading in a small cap universe is more costly than trading in a large cap one, so you should pay around 0.5% in expenses for these funds. Even a penny more is a waste.

3. Value beta: This beta measures a fund manager’s exposure to distressed or value stocks. These stocks usually have high book-to-market ratios because their market prices are depressed. One common theory is that value stocks have higher returns because they bear more risk. Again, whether or not you agree is irrelevant. Take into account the value effect when determining your fund manager’s performance. If he achieves high returns simply by investing in distressed (value) stocks, don’t reward him by paying excess fees for his services. Funds such as Fama’s Dimensional Fund Advisors charge around 0.5% in expenses for investing in small cap value stocks. These investments are pretty mechanical, so anything more than 0.5% in management fees is too much. Warren Buffett has always invested in value stocks. During the past decade, he continued to do so even when he didn’t have alpha. That’s why Berkshire Hathaway achieved 6% annual returns between 2000 and 2009. Anyone with a computer and a brokerage account could have achieved 10%+ in annual returns simply by buying value stocks and selling growth stocks within the same time period.

4. Momentum beta:This beta measures a fund manager’s exposure to momentum stocks. These are the stocks that have been increasing recently. Most academicians can’t even explain this because this is totally against their Efficient Markets Hypothesis. Theoretically, you shouldn’t be able to predict a stock’s future direction by looking at its past performance. Some might argue that momentum stocks are more risky. Again, your opinion doesn’t matter. Since it’s known to generate excess returns and there are some low cost momentum funds employing this style, don’t overpay your fund manager (not more than 50 basis points per year) if his returns are based on this investment style.

In short, don’t reward fund managers who simply monkey (imitate) these four basic investment styles in all economic environments. What needs to be identified is when the manager has alpha – or when he has the skill to outperform these styles by picking the right stocks. It’s when he has essentially shown his exceptional skill.

For example, suppose we have a value fund manager who’s been investing consistently in value stocks. You invest your hard earned dollars with this fund manager, knowing full well that he’s a value investor. Suppose during the first year the S&P 500 index returns 3%, your fund manager returns 13% and value stocks in general return 15%. Yes, he out performed the market by 10%, but he’s really just a poor fund manager. He underperformed his investment style. If you think he’ll consistently underperform his benchmark, just move your funds to another manager who can at least match the performance of his value investing style. You shouldn’t be paying more than 0.5% to cover expenses (even though he doesn’t really deserve a dime.)

Usually one year is too short to determine if a fund manager has any alpha. Performance analysis based on 5 or 10 year performance data will yield more robust results about the alpha of the fund manager. The methodology described above is usually sufficient to determine the alpha of most mutual funds and long-short equity hedge funds*. If you believe a fund manager has alpha, don’t pay more than 2% in fixed fees and 20% in performance fees above a threshold (such as LIBOR+200 basis points). Actually, it’s a well known fact that most mutual fund managers don’t have any alpha. And really, if a mutual fund manager really has alpha, he’ll probably launch his hedge fund soon to get paid in proportion to his talent.

*some fund managers don’t stick to one investment style, but do invest in derivatives, commodities, and/or international stocks/bonds. These situations require more specific methodologies.