During the first half of the fourth quarter the Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by about 4 percentage points as investors worried over the possible ramifications of rising interest rates. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Zafgen Inc (NASDAQ:ZFGN) and see how the stock is affected by the recent hedge fund activity.

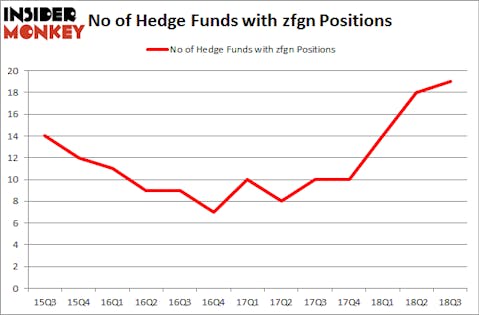

Zafgen Inc (NASDAQ:ZFGN) was in 19 hedge funds’ portfolios at the end of September. ZFGN shareholders have witnessed an increase in hedge fund sentiment lately. There were 18 hedge funds in our database with ZFGN positions at the end of the previous quarter. Our calculations also showed that zfgn isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding Zafgen Inc (NASDAQ:ZFGN).

What does the smart money think about Zafgen Inc (NASDAQ:ZFGN)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ZFGN over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Great Point Partners was the largest shareholder of Zafgen Inc (NASDAQ:ZFGN), with a stake worth $39.6 million reported as of the end of September. Trailing Great Point Partners was Farallon Capital, which amassed a stake valued at $19 million. 683 Capital Partners, Armistice Capital, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have jumped into Zafgen Inc (NASDAQ:ZFGN) headfirst. BlueCrest Capital Mgmt., managed by Michael Platt and William Reeves, initiated the largest position in Zafgen Inc (NASDAQ:ZFGN). BlueCrest Capital Mgmt. had $0.2 million invested in the company at the end of the quarter. John Overdeck and David Siegel’s Two Sigma Advisors also made a $0.2 million investment in the stock during the quarter.

Let’s go over hedge fund activity in other stocks similar to Zafgen Inc (NASDAQ:ZFGN). These stocks are Calix Inc (NYSE:CALX), Corbus Pharmaceuticals Holdings Inc (NASDAQ:CRBP), General Finance Corporation (NASDAQ:GFN), and Sentinel Energy Services Inc. (NASDAQ:STNL). This group of stocks’ market caps match ZFGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CALX | 12 | 77721 | 0 |

| CRBP | 5 | 33364 | -1 |

| GFN | 8 | 17198 | 2 |

| STNL | 15 | 135561 | -1 |

| Average | 10 | 65961 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10 hedge funds with bullish positions and the average amount invested in these stocks was $66 million. That figure was $157 million in ZFGN’s case. Sentinel Energy Services Inc. (NASDAQ:STNL) is the most popular stock in this table. On the other hand Corbus Pharmaceuticals Holdings Inc (NASDAQ:CRBP) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Zafgen Inc (NASDAQ:ZFGN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.