Online video streaming in the second biggest economy of the world is the next big thing.

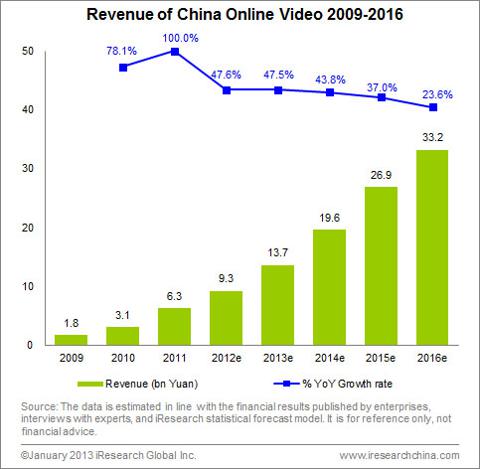

But how big is this market? According to iResearch, revenue from online video in China is expected to grow to 33.2 billion yuan ($5.4 billion) in 2016, up from 6.3 billion yuan in 2011: an amazing growth rate shows that this is a huge market in the making. Most of that will come from advertising.

That’s why companies like Baidu.com, Inc. (ADR) (NASDAQ:BIDU), which started as a search engine; and Renren Inc (NYSE:RENN), which started as a social network; are trying to catch up as soon as possible. Baidu’s recent acquisitions confirm that the giant is not going to let this opportunity go. And Youku Tudou Inc (ADR) (NYSE:YOKU), which has been streaming video since 2006 and is considered the second largest video site in the world with an Alexa ranking just after YouTube, isn’t going to make its competitors’ life easy. The market certainly looks fierce, but somebody has to win. Who’s that going to be?

Baidu and its acquisitions

Baidu.com, Inc. (ADR) (NASDAQ:BIDU) is using the more than $5 billion in cash and cash equivalents it has to reinforce its online video business, iQiyi. That’s why the company recently spent $370 million to buy PPS. By merging PPS’s user base with iQiyi’s, Baidu is expected to become the largest online video platform, by number of mobile users and video viewing time.

But Baidu.com, Inc. (ADR) (NASDAQ:BIDU) isn’t strong just because of its aggressive acquisitions (in a similar move, it recently paid $306 million for majority stake in top travel search engine Qunar). Baidu’s competitive advantage is that by owning the biggest search engine in China, it can easily shift some of its search engine traffic to its new products, like iQiyi.

PPS also happens to be a good complement to iQiyi’s traffic. Most iQiyi users watched videos via Web browser, while PPS is strong at delivering video content via mobile terminals or software. Mobile video streaming is probably the fastest growing segment and it also enjoys higher user retention rates. That’s why the PPS acquisition makes a lot of sense.

That being said, nobody knows if Baidu.com, Inc. (ADR) (NASDAQ:BIDU) will be able to succeed in its new ventures. From e-commerce to real estate, iQiyi is just another product inside Baidu’s fast-growing portfolio of products. The company is unfamiliar with most of these new businesses, but it has the advantage of counting with the most used search engine in China to drive traffic to its services.

Youku Tudou: 19% share of Chinese online video market and counting

Baidu.com, Inc. (ADR) (NASDAQ:BIDU)’s recent acquisition of PPS can be seen as a reaction to the merger between Youku and Tudou last year, which created one of the biggest online video content platforms in China. As of December 2012, Youku Tudou Inc (ADR) (NYSE:YOKU) had more than 4,500 movie titles, 2,700 television serial drama titles, relationships with 1,800 professional media content owners and over 900 variety shows. It’s also doing well with its monetized version, Youku Premium, which has processed more than 4.5 million paid orders since December 2010.

So how big is Youku Tudou Inc (ADR) (NYSE:YOKU)? In terms of mobile, it may be below Baidu in size: it had 100 million monthly mobile users and 80 million mobile apps installed at 2012. Since there was a 50% quarterly growth in mobile daily activity, the number of apps installed in mobiles should be much bigger by now. There should be at least 200 million monthly users by now. Now, Youku Tudou seems to be spending more money in content than Baidu. In 2012, Youku Tudou Inc (ADR) (NYSE:YOKU)’s content costs were roughly $118 million and Baidu’s content costs were roughly $35 million. But revenue may be higher (than iQiyi) as well, considering that Youku Tudou has a premium version active.

The strength of Youku Tudou Inc (ADR) (NYSE:YOKU) relies on its monthly unique visitors from home and office PC users: about 260 million for the Youku platform in December 2012. That being said, the company knows well the importance of mobile. In the first quarter earnings call, it was announced that mobile traffic increased 50% quarter-over-quarter to over 170 million daily video views.

Renren’s trying hard too, but…

Renren bought 56.com, a video streaming service, for $80 million in 2011. 56.com’s content is mostly user generated, so Renren doesn’t have to pay high content fees. Also, since Renren has one of the most popular social platforms in China with more than a 100 million registered users, I expect interesting synergies and cross marketing opportunities between 56.com and the social network, in order to drive more traffic and user engagement.

However, it should be noted that video for Renren is just another venture. The company is fighting to improve the growth of its gaming platform, group-buying site (nuomi.com), wedding site (jiexi.com) and professional network (jingwei.com).

The problem of Renren is not a lack of new ventures. They have too many projects. The real problem is that Renren is not showing signals of strong monetization know-how. In the latest earnings call, Renren reported that of the $46.6 million in revenue, online advertising revenues were $9.8 million. This is just a slight increase of 5% from the same period of 2012. In the next quarters, investors will demand more monetization and, specifically, more growth in advertisement revenue. Faced with this pressure, Renren might give more priority to Nuomi.com (which may be a cash cow in the making) and Renren.com (which has a consolidated and well engaged user base) in the medium run.

The bottom line

The Chinese online video streaming market looks extremely promising. Particularly, mobile sites offering video services will experience amazing growth, as Chinese shift from TV to Internet in order to watch movies, and as the smartphone and Internet penetration rates increase in the next 3 years.

The down side is that such an attractive market also represents an open invitation to start ups, tech giants and anybody interested in getting a piece of this huge market in the making. Competition is already fierce.

If you want to add exposure to this particular market, I recommend considering buying Baidu.com, Inc. (ADR) (NASDAQ:BIDU) (probably the biggest video platform in terms of mobile users). Baidu has everything to succeed in this fierce market and it has strong mobile exposure. Youku Tudou Inc (ADR) (NYSE:YOKU) has a strong web presence but keep in mind that the firm is not yet consistently profitable. Renren Inc (NYSE:RENN), on the other hand, may have more attractive businesses than its video platform. For example, the Groupon-like Nuomi.com business posted 102% Year over Year revenue growth ($5.1 quarterly earnings) in the last quarter.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Baidu. The Motley Fool owns shares of Baidu.

The article This Company Is a Chinese Youtube in the Making: Here’s Why originally appeared on Fool.com and is written by Adrian Campos.

Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.