In the first hours of trading, the markets showed slight signs of improvement, impacted by positive jobless claims data. In this way, the Dow Jones Industrial Average and the S&P 500 Indices inched up by some 0.40%, while the NASDAQ Composite added around 0.80%. However, there were a number of stocks that stood out in the morning in terms of both price movements and trading volume and in this article we will take a look at one healthcare company that surged right after the bell and one semiconductor stock that lost a lot of ground. We will not only look at the developments behind these moves, but will also take a look at what hedge funds think about these three companies.

We analyze the popularity of a company among a pool of over 700 hedge funds in the context of our small-cap strategy, which has returned over 118% since it was launched live in August 2012 and has outperformed the market by more than 60 percentage points. The strategy involves imitating a portfolio of 15 most popular small-cap stocks among hedge funds and it is based on backtests spanning through the period between 1999 and 2012. Our research showed that the returns of these stocks can beat the market by an average of 95 basis points per month, while hedge funds’ most popular picks, including mostly large companies, trailed the market by some seven basis points per month, which is mostly due to the wide coverage they receive (read more about our backtests here).

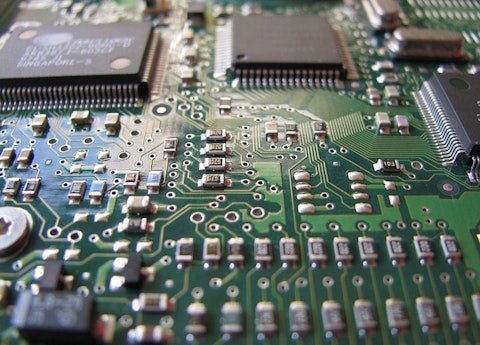

With this in mind, let’s start with the only non-healthcare company and the only loser from our compilation, Sigma Designs Inc (NASDAQ:SIGM). The stock of the $390 million provider of semiconductor solutions has dropped by 13% so far today on a trading volume more than double higher than average, on the back of financial results for the second quarter of fiscal 2016 (ended August 1), which included revenues of $58.3 million and non-GAAP earnings per share of $0.12, versus $42.8 million and $0.06 reported a year earlier. EPS also came higher above estimates of $0.06. Sigma Designs Inc (NASDAQ:SIGM)’s stock opened higher, so it’s really not clear what are the reasons behind the decline. Nevertheless, it is up by 43% year-to-date, despite today’s loss, but the hedge fund sentiment regarding the company is uncertain. At the end of June, 19 funds from our database disclosed long positions in the company, down from 21 a quarter earlier, while the aggregate value of their stakes advanced to $62.27 million from $54.25 million, fueled by a 33% growth of the stock during the period. The largest shareholder of Sigma Designs Inc (NASDAQ:SIGM) in our database is Jim Simons’ Renaissance Technologies, which holds 2.16 million shares as of the end of June, up by 50% on the quarter.