Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards Workday Inc (NYSE:WDAY).

Is Workday Inc (NYSE:WDAY) a buy, sell, or hold? Prominent investors are in an optimistic mood. The number of bullish hedge fund bets went up by 4 in recent months. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Credicorp Ltd. (USA) (NYSE:BAP), Parker-Hannifin Corporation (NYSE:PH), and Entergy Corporation (NYSE:ETR) to gather more data points.

Follow Workday Inc. (NASDAQ:WDAY)

Follow Workday Inc. (NASDAQ:WDAY)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

oneinchpunch/Shutterstock.com

Now, let’s take a look at the recent action encompassing Workday Inc (NYSE:WDAY).

What does the smart money think about Workday Inc (NYSE:WDAY)?

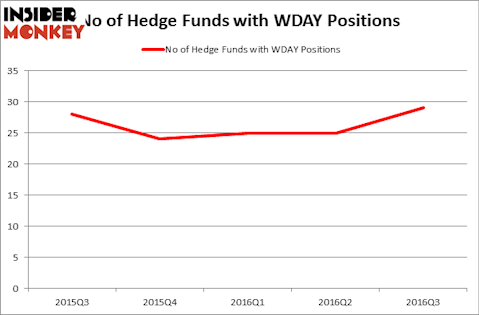

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a rise of 16% from the second quarter of 2016. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Matrix Capital Management, managed by David Goel and Paul Ferri, holds the number one position in Workday Inc (NYSE:WDAY). Matrix Capital Management has a $468.6 million position in the stock, comprising 19.7% of its 13F portfolio. Coming in second is Tybourne Capital Management, led by Eashwar Krishnan, holding a $220 million position; the fund has 11% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Christopher Lord’s Criterion Capital, and John Overdeck and David Siegel’s Two Sigma Advisors.