VR Stocks That Will Benefit from the Industry’s Projected Growth: Predicting how the market will react to new technologies is perilous, as evidenced by the commercial failure of Google Glass. We were all supposed to look like giant dorks at this point, wearing our eyepieces everywhere and gesticulating haphazardly to control them. Instead, Glass died a quick death as a mass market commercial product, though it’s rumored that Alphabet Inc (NASDAQ:GOOGL) could bring Glass back in augmented reality (AR) form. Likewise, the 3-D printing craze that was supposed to revolutionize, well, everything, hasn’t quite materialized.

Fittingly, estimates of the VR industry’s growth vary widely, with Grand View Research predicting it to be a $48.5 billion industry by 2025, while Greenland Insights predicts much faster growth, with the industry projected to hit $74.8 billion by 2021. On the other hand, Superdata predicts that the industry will only reach $28.5 billion by 2020, though that would still represent immense growth from the $2.2 billion size of the industry in 2017.

VR is undeniably a booming industry, regardless of how much it ultimately disrupts the travel industry or not. In addition to Sony Corp (ADR) (NYSE:SNE), Facebook Inc (NASDAQ:FB), and Intel Corporation (NASDAQ:INTC), other stocks with burgeoning VR potential include Microsoft Corporation (NASDAQ:MSFT), Ambarella Inc (NASDAQ:AMBA), Himax Technologies, Inc. (ADR) (NASDAQ:HIMX), and Vuzix Corporation (NASDAQ:VUZI).

Vuzix Corporation (NASDAQ:VUZI), which received a $25 million investment from none other than Intel Corporation (NASDAQ:INTC), could grow its revenue ten-fold by 2020 according to investment banking firm Craig-Hallum. The small company has developed the well-received M100 headset and is also dipping its toes into smart glasses, having inked a deal with Toshiba last year to develop two such products for the company.

Ambarella Inc (NASDAQ:AMBA), which is well-known in the drone camera space, is also cautiously optimistic about the VR camera space, having introduced the first 8K Ultra HD chip for use with VR and other cameras early last year. While Ambarella’s current growth is sluggish due to declining GoPro Inc (NASDAQ:GPRO) sales, VR is expected to be a bright spot for the company in the near-to-medium term.

Likewise, Himax Technologies, Inc. (ADR) (NASDAQ:HIMX) is facing some short-term pressure due to iPhone X weakness, but its revenue and margins are expected to grow tremendously in the coming years thanks to augmented and virtual reality being directly incorporated into smartphones, as well as big product releases from Microsoft Corporation (NASDAQ:MSFT) (Hololens) and Facebook (Oculus Go).

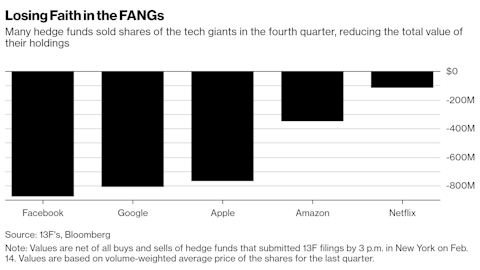

Hedge Funds Losing Faith in Airline Stocks?: Several airline stocks lost notable support in the fourth-quarter from the 662 active hedge funds tracked by Insider Monkey. Just 19 of those hedge funds owned Spirit Airlines Incorporated (NASDAQ:SAVE) at the end of 2017, down from 28 a quarter earlier. American Airlines Group Inc (NASDAQ:AAL) (down by nine to 39) and Alaska Air Group, Inc. (NYSE:ALK) (down by 9 to 33), also lost sizable chunks of their hedge fund support.

On the other hand, many investors clearly aren’t too concerned about any looming VR threat to the sector. Take legendary billionaire investor Warren Buffett, who just sent airline stocks flying high this week after he told CNBC that he would consider purchasing an airline. His $520 billion holding company Berkshire Hathaway Inc. (NYSE:BRK.A) received a $29 billion windfall from Republican tax cuts in 2017 and has cash to spend (and a lot of it).

While the threat isn’t imminent, it is coming sooner than later, and there may not be much that the travel industry can do to stop it. However, consumer preferences will ultimately be the judge of whether VR takes off. If people don’t want to go on VR holidays, then the best tech in the world will do little to change that. Will they? We simply don’t know the answer yet. But it’s something that investors of both industries will need to closely monitor.

Disclosure: None