Baron Funds, an investment management company, released its “Baron Durable Advantage Fund” third quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund declined 5.0% (Institutional Shares) compared to a 4.9% decline for the S&P 500 Index. Holdings in Health Care, Industrials, and Consumer Staples contributed to the fund’s relative performance in the quarter, whereas holdings in Financials, Consumer Discretionary, and Information Technology detracted. In addition, please check the fund’s top five holdings to know its best picks in 2022.

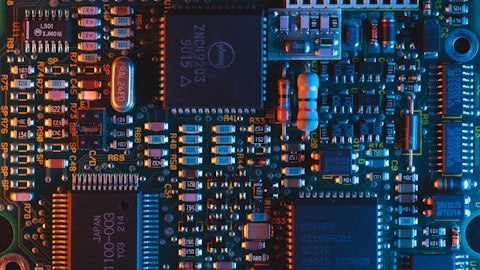

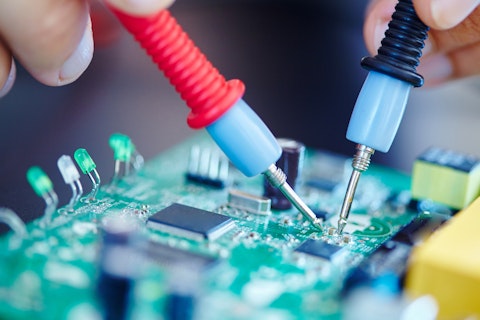

Baron Funds highlighted stocks like Texas Instruments Incorporated (NASDAQ:TXN) in the third quarter 2022 investor letter. Headquartered in Dallas, Texas, Texas Instruments Incorporated (NASDAQ:TXN) designs and manufacturers semiconductors. On November 15, 2022, Texas Instruments Incorporated (NASDAQ:TXN) stock closed at $177.57 per share. One-month return of Texas Instruments Incorporated (NASDAQ:TXN) was 17.20%, and its shares lost 17.27% of their value over the last 52 weeks. Texas Instruments Incorporated (NASDAQ:TXN) has a market capitalization of $161.158 billion.

Baron Funds made the following comment about Texas Instruments Incorporated (NASDAQ:TXN) in its Q3 2022 investor letter:

“Shares of Texas Instruments Incorporated (NASDAQ:TXN), the leading global analog semiconductor company, rose 1% during the quarter after the company reported strong financial results with revenue growth of 14% year-over-year, operating profit growth of 23%, and operating margins of 52%. While the level of uncertainty over near-term revenue and free-cash-flow trends has risen due to a potential macro slowdown and supply-chain normalization, Texas Instruments has a long history of growing free-cashflow-per-share over full-market cycles to drive shareholder value. We remain investors and believe that Texas Instruments will benefit from the growth in semiconductor content across a broadening set of end-markets and applications. In addition, we believe that the company will be able to sustain its competitive advantages for the long term, underpinned by its manufacturing technology and process, its broad product portfolio, the reach of its go-to-market organization, and the diversity and longevity of its products.”

allstars/Shutterstock.com

Texas Instruments Incorporated (NASDAQ:TXN) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 55 hedge fund portfolios held Texas Instruments Incorporated (NASDAQ:TXN) at the end of the second quarter, which was 46 in the previous quarter.

We discussed Texas Instruments Incorporated (NASDAQ:TXN) in another article and shared the list of biggest tech companies in the world after the 2022 stock market collapse. In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 16 Biggest Gig Economy Companies in the World

- 11 Best Materials Dividend Stocks To Buy

- Dividend Kings List By Yield

Disclosure: None. This article is originally published at Insider Monkey.