With that in mind, and the Fed’s Comprehensive Capital Analysis and Review (CCAR) results set to be released this week, Regions Financial Corporation (NYSE:RF) investors may be itching to find out if the bank will be able to raise its dividend.

How it fared last week

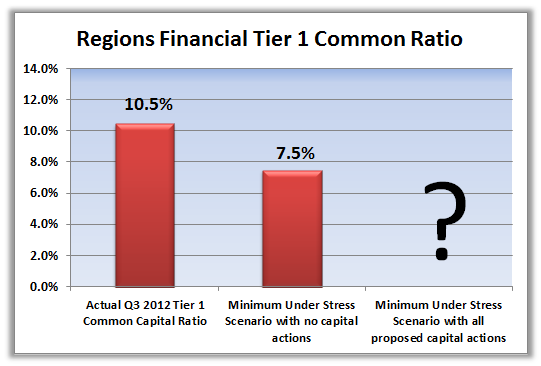

This year was the first year that the Fed ran through the Dodd-Frank portion of the stress tests, so we don’t have an exact comparison from last year. However, stacking Dodd-Frank results against last year’s CCAR — excluding the proposed capital actions — is a reasonable comparison. On that basis, Regions Financial Corporation (NYSE:RF)’ minimum stressed tier 1 common ratio of 7.5% compares very well to last year’s 5.7% from the CCAR.

While that makes the prospect of capital distributions look promising, investors will still have to wait until Thursday to see how those capital plans shake out. To be sure, even if the bank has room to pay a higher dividend, that doesn’t mean its management team will ask for one.

Source: Dodd-Frank Act Stress Test 2013: Supervisory Stress Test Methodology and Results.

Should Regions request a dividend bump?

This time last year, Regions Financial Corporation (NYSE:RF) still had the government’s TARP investment sitting on its balance sheet. When the CCAR rolled around, instead of asking for a higher dividend or share buybacks, management focused its capital plan on raising additional capital through a $900 million stock offering so it could finally pay down TARP.

This time around, Regions Financial Corporation (NYSE:RF) appears to be much better positioned to ask for capital distributions. Though I’m a big proponent of dividends, considering that Regions Financial Corporation (NYSE:RF) is trading at a steep discount to its book value and only a slight premium to tangible book value, asking for a share buyback could be beneficial for shareholders.

That said, with the bank just one year out from paying down TARP and continuing to improve its balance sheet — at year end, nonperforming loans were still 2.4% of total loans — I couldn’t blame management for holding off on a distribution request altogether.

How much?

I think slow and steady wins the race here for Regions Financial Corporation (NYSE:RF). As I noted above, I wouldn’t be too surprised if management waited on asking for distributions. If it does, the best approach in my view would be to inch up its dividend, and perhaps combine that with a modest buyback.

For investors getting in on Regions today, the opportunity lies in the stock’s low valuation and the bank’s ability to rebuild and grow over the long term, not a breakneck rush to push up the dividend.

The article Will Regions Financial Increase Its Dividend? originally appeared on Fool.com and is written by Matt Koppenheffer.

Matt Koppenheffer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.