But in the past two years the company has begun catching up, causing the stock price to rise 25% between February and May this year and allowing Bill gates to take back the title of world’s richest man. And just when everybody thought Microsoft Corporation (NASDAQ:MSFT) was back, a massive market correction last Friday, July 26, after Microsoft Corporation (NASDAQ:MSFT) posted weak earnings takes down half the returns shareholders accumulated so far this year. After a weak earnings call, is Microsoft Corporation (NASDAQ:MSFT) still a good investment?

Explaining the poor quarter

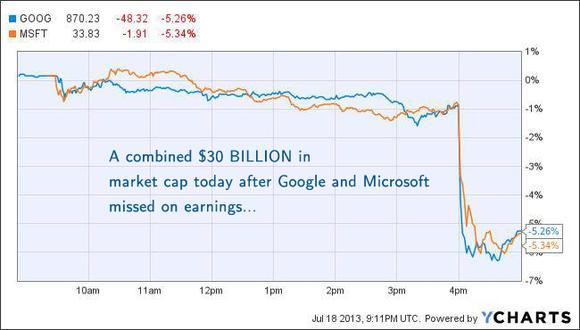

Let’s start with the facts. In the latest earnings call, Microsoft Corporation (NASDAQ:MSFT) missed guidance for every single division and announced a massive $900-million write-down on the value of its unsold Surface tablets, which the market doesn’t seem to fancy. At one point, the announcement caused shares to drop 12%. Combined with Google Inc (NASDAQ:GOOG), which also missed on earnings, both companies lost more than $30 billion in market cap after announcing their quarterly results. At this point, it’s natural to wonder if the market overreacted or not.

Microsoft still dominates the PC Operating System business, which is shrinking globally. With 58% of its total sales and 72% of its operating income coming from the PC Industry, Microsoft is surely exposed to this fact. As shipments continue falling (according to Gartner, worldwide PC shipments dropped to 76 million units in the second quarter of 2013, a 10.9% decrease) and the company shows no convincing signal that it can find another cash cow (looking at the latest figures, we can be sure the Azure business is certainly not going to replace the PC business!) in the medium run, it’s natural for investors to worry.

Even worse, Microsoft is bleeding a lot of cash out of its Online Services Division (in charge of its Bing search engine). Since 2005, the company has reported losses of almost $12 billion from its online operations!

The disappointing results give us the idea that Microsoft did try to diversify its business by focusing on Azure tables and online advertisement with Bing. But it’s not working.

Why I believe there is hope

Although there are many reasons to be a bear, I prefer to take a neutral position here. Microsoft is still far away from reaching Apple Inc. (NASDAQ:AAPL) in the tablet market, and even farther away from reaching Google Inc (NASDAQ:GOOG) in the online services market. Yet, the giant is well aware of its market share problems and is committed to find its way to success, even if that implies burning a lot of cash in the short run. Also, unlike Google, Microsoft doesn’t have to deal with high market expectations. I will explain more about this in the next section.

In the tablets market, Microsoft has formidable competitors. Yet, Microsoft has a unique competitive advantage: most PC users are already accustomed to Windows, and they probably will be willing to stay using a similar OS when they shift to tablets.

As for smartphones, the current alliance between Microsoft and Nokia to promote the Windows Phone OS will help to increase market share in the coming quarters, assuming Lumia sales perform better than expected. Gartner again predicts that by 2017 although 1.5 billion devices will run Google’s Android, the amount of devices running Windows and the amount of Apple Inc. (NASDAQ:AAPL) devices will be, roughly speaking, the same: 570 million and 504 million, respectively. To me, this is an upside, because it’s a great progress considering Microsoft was late in the smartphone revolution.

Finally, there’s Windows 8. So far Microsoft has sold fewer copies than what analysts expected, but that can be easily explained. At the moment, the PC business is shrinking. Some have seen this as the last chapter in the PC history, but for me, this is only a transition. The new PC is touch-screen, has an OS that allows for easy integration with smartphone and tablet devices and relies heavily on cloud software. This market is still relatively new, but the fact that Google (I’m referring mainly to the Google Chromebook business, still at an early stage) is also addressing it early confirms my views that the PC world won’t die. It will change. This is a clear upside for Microsoft, it’s Surface Pro hybrid and Windows 8, whose integrated launch should emphasize more the advantages of using it with Office 365 and Skydrive.

So, how about the online business? The tacit street consensus may be that, Bing included, nobody can ever reach Google’s search engine popularity. Well, I wouldn’t be so sure. ComScore Media Metrix shows Yahoo! is very close to reaching Google in terms of U.S. unique visitors.

As a matter of fact, Bing is actually showing some strong growth figures, not in terms of revenue, but in terms of traffic metrics. The latest data shows Bing’s market share actually hit a record high of 17.9% of desktop search queries, coming at the expense of Yahoo! Google’s 66.7% looks far away now, but the internet is a fast changing environment, and there is nothing theoretically impeding Bing from becoming a massively used engine in the future.

Undervalued!

Now, some thoughts on valuation. To estimate the real value of Microsoft, I run a discounted cash flow valuation using Old School Value financial spreadsheets. My assumptions are as follows: the 10 years past free cash flow median growth rate (7.8%) is used for the average growth rate of the next 10 years. Next, I assume a terminal growth rate of 3%. Considering the company remains financially strong, I assume a 12% discount rate. My result indicates that the fair value estimate for Microsoft is $50.39 per share, almost $20 above the current stock price. As a result, Microsoft is clearly undervalued: from a valuation perspective, the stock could increase 50% more in the near future.

Notice my results are consistent with Microsoft’s ability so far to generate a consistently high free cash flow. Although I am quite a Microsoft bull, the Street also believes Microsoft is undervalued: Morningstar has a fair price estimate of $35 per share, and FT.com mentions that 32 analysts offering 12 month price targets for Microsoft have a median target of $35 dollars as well, with a high estimate of $41 per share.

Also keep in mind that Microsoft’s current PE ratio is relatively low, suggesting a cheap market valuation: 12.19. For comparison, the Standard & Poor’s 500 average is 16.9, Google’s PE is 27.08 and Apple, 12.19.

Bottom line

With the second most popular smartphone operating system by 2017, better tablet sales as traditional Windows PC users shift to tablets and the still strong OS, Windows 8, in a new PC world, Microsoft’s future cash flow generation may not sound bombastic, but looks pretty safe to me. Add to this the effect that dividends and share buybacks can have to mitigate short term losses and a huge R&D spending budget ($10.4 billion for fiscal 2013) committed to innovation, and you may not get a company as “cool” as Google or Apple, but you certainly have a great investment.

The article Will Microsoft Become the IT King Again? originally appeared on Fool.com and is written by Adrian Campos.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Apple and Google. The Motley Fool owns shares of Apple, Google, and Microsoft. Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.