Artisan Partners, an investment management company, released its “Artisan Value Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. In the fourth quarter, the fund outperformed the Russell 1000 Value Index. Its Investor Class fund ARTLX returned 14.04%, Advisor Class fund APDLX posted a return of 14.14%, and Institutional Class fund APHLX returned 14.10% in the quarter, compared to a 12.42% return for the benchmark index. Positive stock selection led to the outperformance of the fund in the quarter. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Artisan Value Fund highlighted stocks like Koninklijke Philips N.V. (NYSE:PHG) in the Q4 2022 investor letter. Headquartered in Amsterdam, the Netherlands, Koninklijke Philips N.V. (NYSE:PHG) is a health technology company. On March 1, 2023, Koninklijke Philips N.V. (NYSE:PHG) stock closed at $16.10 per share. One-month return of Koninklijke Philips N.V. (NYSE:PHG) was -11.68%, and its shares lost 48.61% of their value over the last 52 weeks. Koninklijke Philips N.V. (NYSE:PHG) has a market capitalization of $14.448 billion.

Artisan Value Fund made the following comment about Koninklijke Philips N.V. (NYSE:PHG) in its Q4 2022 investor letter:

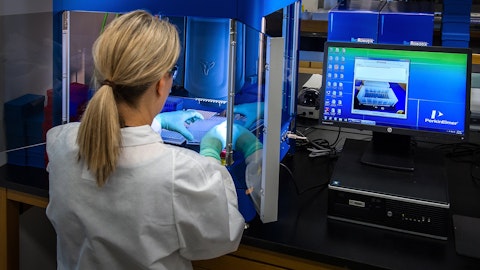

“Shares of Koninklijke Philips N.V. (NYSE:PHG), a health care technology company, were hurt by fears regarding the recall of its first-generation CPAP machine and the potential for legal recourse and market share losses arising in its sleep division. Adding to the company’s woes are supply chain disruptions and a worsening macro environment that will weigh on deliveries and customer installations. The stock is down more than 70%, losing more than €30 billion in market value from its April 2021 highs. The stock reaction seems excessive given the likely range of outcomes we see, so we’ve been adding to our position. The sleep division is a small part of the overall business—which we do not believe is going to zero. The company has a large installed base of medical diagnostic equipment (e.g., MRI/PET/CT/ultrasound scanners) that offers a high recurring stream of software-like maintenance revenues. This is a sticky business as medical providers are reluctant to switch over to competitors. We appreciate that until there is greater clarity on the full impact of the recall and how long it may take to resolve, the stock will remain under pressure, but we believe today’s asking price offers the potential for highly attractive multi-year returns.”

ESB Professional/Shutterstock.com

Koninklijke Philips N.V. (NYSE:PHG) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 12 hedge fund portfolios held Koninklijke Philips N.V. (NYSE:PHG) at the end of the fourth quarter which was 8 in the previous quarter.

We discussed Koninklijke Philips N.V. (NYSE:PHG) in another article and shared the list of best European dividend stocks to buy. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 11 Most Profitable Energy Stocks

- 11 Most Promising Cancer Stocks

- Billionaire Ken Fisher’s New Purchases

Disclosure: None. This article is originally published at Insider Monkey.