With the world’s largest iron ore miner Brazil’s Vale SA (ADR) (NYSE:VALE) now trading at lows not seen since 2007, many investors are convinced that now is the time to invest in the company. For the year to date the company’s share price is down by almost 33%, having recently touched a new 52-week low of $14.20. However, it is not only Vale SA (ADR) (NYSE:VALE) that has taken a beating, all of the major iron ore miners including Cliffs Natural Resources Inc (NYSE:CLF), BHP Billiton plc (ADR) (NYSE:BBL) and Rio Tinto plc (ADR) (NYSE:RIO) have seen their share prices plunge. The key drivers of this selloff have been a declining iron ore price along with lower economic growth in China and in this article I will explain why investors should be cautious about investing in Vale.

The performance of iron ore miners is closely linked to the outlook for China and the iron ore price and this is particularly so for Vale SA (ADR) (NYSE:VALE) the world’s largest iron ore miner and Cliffs Natural Resources Inc (NYSE:CLF), with both receiving in excess of 70% of their revenue from iron ore. Whereas Rio and BHP Billiton plc (ADR) (NYSE:BBL) are diversified miners with operations producing a range of commodities making their sales and profitability far more sustainable in the current environment.

China’s economic outlook continues to decline

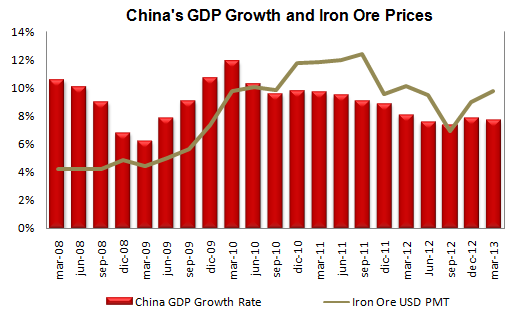

A key driver of demand and pricing for iron ore and hence the share price of iron ore miners, has been the overwhelming demand for the commodity from China as the chart illustrates.

Source data: National Bureau of Statistics of China and Bloomberg.

The rapid growth of China’s economy and the ensuing demand for commodities saw the creation of what has been called a resources super-cycle, triggering a boom across the mining industry globally, seeing record profits and investment. But this boom has now come to an end and while there will continue to be demand for iron ore and other commodities globally, there will be no return to the heady highs of iron ore prices reaching almost $190 per metric ton. This is because China’s economy has continued to slow with GDP growth estimated to be 7.8% in 2013, 7.9% in 2014, and 7% in 2015, which are significantly lower than the historical Chinese growth rates needed to drive iron ore prices higher.

Latest economic data indicates that demand for iron ore will continue to fall

The latest economic data from China indicates an increasingly likelihood that demand for iron ore will not significantly increase any time soon, with the May 2013 manufacturing PMI increasing by a modest 20 bps month on month to 50.8%, as illustrated by the chart below.

Source: National Bureau of Statistics of China.

This doesn’t bode well for increased industrial demand for commodities such as iron ore and I don’t expect to see any significant growth in China’s industrial PMI over the short-term.

All of which has already applied downward pressure to the iron ore price, seeing it fall by 23% for the year to date to $116.60 per metric ton and over the long-term I expect the price to fall further to around $90 per metric ton. All of which doesn’t bode well for increasing demand for iron ore or the profitability of Vale SA (ADR) (NYSE:VALE).

Shareholder remuneration remains under pressure

It is likely that as Vale SA (ADR) (NYSE:VALE)’s profitability declines it will continue to cut its dividend payments. Already for 2013 Vale has cut its dividend payment by a third, reducing its dividend yield to around 5%. This yield is superior to Rio`s and BHP’s 4% and Cliff’s 3%, although I don’t expect the same degree of pressure to be applied to either Rio Tinto plc (ADR) (NYSE:RIO)’s or BHP’s dividend payment as iron ore prices continue to fall. This is because both miners have diversified operations, with only a third of their revenue being derived from iron ore.

Just how cheap is Vale at this time?

At this time Vale SA (ADR) (NYSE:VALE) appears to be particularly cheap with a price to book ratio of 2 and an enterprise value to EBITDA ratio of 6. But as the table below illustrates, both Cliff’s and Rio appear to be far better value on the basis of those metrics.

Source data: Yahoo Finance, Y Charts and Fidelity.

Furthermore, while I am confident that BHP and Rio can continue to grow profitability in an environment where iron ore prices are continuing to fall by virtue of their diversified operations, I do not believe that Vale or Cliff’s can. This is because of the significant dependence on iron ore sales as a driver of revenue.

The impact of the falling iron ore prices on Vale’s financial performance can already be seen in the company’s first quarter 2013 performance, with revenue falling by almost 33% quarter on quarter to $10 billion. While net income more than doubled for the same period to almost $3 billion. The almost doubling in net income, despite appearing to be a solid achievement, did not occur because of decreasing costs or increasing profitability but can be primarily attributed to asset write downs that saw the company report a loss in the fourth quarter 2012.

Risks remain high for Vale

Vale SA (ADR) (NYSE:VALE) also continues to remain a far higher risk play for investors than either Rio or BHP, with the company still experiencing problems associated with the shipping costs and times to reach China. Vale is also exposed to increasing political and economic risk in Brazil, with the Rousseff government having defined iron ore as a strategic asset and continuing to pursue Vale for $15.5 billion in additional income taxes that it claims are due on the profits of Vale’s foreign subsidiaries.

Neither Rio, BHP or Cliff’s are exposed to such a high degree of political and economic risk in the countries in which they are domiciled or where they have the majority of their iron ore operations. I also expect to see Rio and BHP continue to cut costs through extensive restructuring operations and the economies of scale available in their operations in north-west Australia.

Bottom line

It is clear that demand for and the price of iron ore price will continue to fall on the back of slowing economic growth in China. This will have a significant impact on Vale’s sales growth and profitability given its significant reliance upon iron ore as a driver of revenue, which may further pressure its ability to pay its dividend. As a result I don’t believe that Vale’s share price has bottomed and that the other diversified miners are better investment opportunities for investors seeking exposure to the sector.

Matt Smith has no position in any stocks mentioned. The Motley Fool owns shares of Companhia Vale Ads. Matt is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

The article Why Vale Has Yet to Bottom originally appeared on Fool.com and is written by Matt Smith.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.