About 95% of the 660 hedge funds tracked by Insider Monkey delivered an average return of 8.3% during the third quarter whereas S&P 500 ETFs returned only 3.3%. This is unlike the actual returns of the hedge funds which seem to be trailing the market, mainly due to two reasons: hedged returns and losses from short positions. Mimicking the long positions of the smart money helps in beating the market. AltaRock Partners is a good example.

AltaRock is a Beverley, Massachusetts-based hedge fund management firm founded by Mark Massey. The firm reported holding a $550.47 million public equity portfolio as of the end of June. AltaRock’s picks returned 12.78% in the third quarter from its 9 long positions in companies which have a market cap of at least $1 billion. It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions. In this article, we’ll take a look at the performance of TransDigm Group Incorporated (NYSE:TDG), Moody’s Corporation (NYSE:MCO), Mastercard Inc (NYSE:MA), and Visa Inc (NYSE:V) during the third quarter, which were some of its top picks.

AltaRock Partners slashed 39% of its position in TransDigm Group Incorporated (NYSE:TDG) during the second quarter, ending the period with a total of 439,148 shares of the company, whose total value was over $155.79 million. The stock returned 9.6% during the third quarter. Heading into the third quarter of 2016, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 7% drop from the first quarter of 2016. Among these funds, Lone Pine Capital held the most valuable stake in TransDigm Group Incorporated (NYSE:TDG), which was worth $627.7 million at the end of the second quarter. On the second spot was Stockbridge Partners which amassed $401.7 million worth of shares. Moreover, Select Equity Group, Third Point, and Blue Ridge Capital were also bullish on TransDigm Group Incorporated (NYSE:TDG).

Follow Transdigm Group Inc (NYSE:TDG)

Follow Transdigm Group Inc (NYSE:TDG)

Receive real-time insider trading and news alerts

AltaRock Partners decreased its stake in Moody’s Corporation (NYSE:MCO) by 4% in the June quarter as it reported ownership of 992,019 shares of the company as of June 30, valued at about $92.96 million. The stock returned 16% during the third quarter. 34 hedge funds in our system were long this stock at the end of June, a 6% dip from the previous quarter. Among these funds, Berkshire Hathaway held the most valuable stake in Moody’s Corporation (NYSE:MCO), which was worth $2.31 billion at the end of the second quarter. On the second spot was Akre Capital Management which amassed $428.4 million worth of shares. Moreover, Egerton Capital Limited and Marshall Wace LLP were also bullish on Moody’s Corporation (NYSE:MCO).

Follow Moodys Corp (NYSE:MCO)

Follow Moodys Corp (NYSE:MCO)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

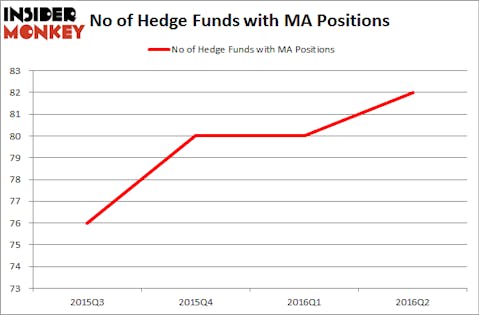

AltaRock Partners retained its stake in Mastercard Inc (NYSE:MA) in the second quarter. AltaRock Partners had a total of 403,690 shares of the company. The net value of this position was over $35.55 million on June 30. The stock returned 15.8% during the third quarter. At Q2’s end, a total of 82 of the hedge funds that we track held long positions in the stock, up by 3% from the first quarter of 2016. The largest stake in Mastercard Inc (NYSE:MA) was held by Gardner Russo & Gardner, which reported holding $857.7 million worth of shares at the end of June. It was followed by Viking Global with a $566.4 million position. Other investors bullish on the company included Renaissance Technologies, Akre Capital Management, and Lone Pine Capital.

Follow Mastercard Inc (NYSE:MA)

Follow Mastercard Inc (NYSE:MA)

Receive real-time insider trading and news alerts

Lastly, AltaRock Partners had a $20.95 million stake in Visa Inc (NYSE:V) at the end of June. The position comprised 282,516 shares of the company. The investment paid off, as the stock returned 11.7% in the third quarter. At the end of the second quarter, a total of 118 of the hedge funds tracked by Insider Monkey held long positions in Visa, 11% more than at the end of the previous quarter. Among these funds, Fisher Asset Management held the most valuable stake in Visa Inc (NYSE:V), which was worth $1.13 billion at the end of the second quarter. On the second spot was Berkshire Hathaway, which amassed $759.4 million worth of shares. Moreover, Lansdowne Partners, Lone Pine Capital, and Soroban Capital Partners were also bullish on Visa Inc (NYSE:V).

Follow Visa Inc. (NYSE:V)

Follow Visa Inc. (NYSE:V)

Receive real-time insider trading and news alerts

Disclosure: None