After several tireless days we have finished crunching the numbers from nearly 900 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of June 30th. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Weyerhaeuser Co. (NYSE:WY).

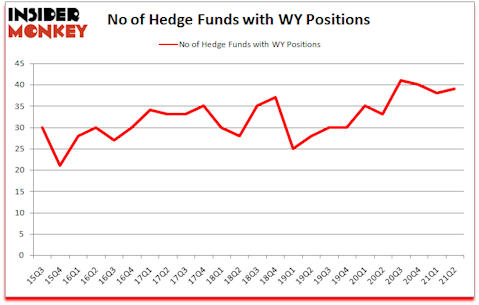

Weyerhaeuser Co. (NYSE:WY) has experienced an increase in enthusiasm from smart money of late. Weyerhaeuser Co. (NYSE:WY) was in 39 hedge funds’ portfolios at the end of June. The all time high for this statistic is 41. There were 38 hedge funds in our database with WY holdings at the end of March. Our calculations also showed that WY isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 79 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Martin Whitman of Third Avenue Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, we like undervalued, EBITDA-positive growth stocks, so we are checking out stock pitches like this emerging biotech stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind we’re going to review the recent hedge fund action encompassing Weyerhaeuser Co. (NYSE:WY).

Do Hedge Funds Think WY Is A Good Stock To Buy Now?

At the end of June, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the previous quarter. The graph below displays the number of hedge funds with bullish position in WY over the last 24 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, 0, managed by Ric Dillon, holds the biggest position in Weyerhaeuser Co. (NYSE:WY). Diamond Hill Capital has a $277.7 million position in the stock, comprising 1.1% of its 13F portfolio. On Diamond Hill Capital’s heels is 0, led by Stuart J. Zimmer, holding a $59.7 million position; 0.8% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors with similar optimism comprise D. E. Shaw’s 0, 0 and Martin Whitman’s 0. In terms of the portfolio weights assigned to each position Third Avenue Management allocated the biggest weight to Weyerhaeuser Co. (NYSE:WY), around 3.77% of its 13F portfolio. Diametric Capital is also relatively very bullish on the stock, setting aside 1.85 percent of its 13F equity portfolio to WY.

Consequently, some big names were breaking ground themselves. Waterfront Capital Partners, managed by Eduardo Abush, created the most outsized position in Weyerhaeuser Co. (NYSE:WY). Waterfront Capital Partners had $23.8 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $21.5 million position during the quarter. The following funds were also among the new WY investors: Paul Marshall and Ian Wace’s Marshall Wace LLP, Gavin Saitowitz and Cisco J. del Valle’s Prelude Capital (previously Springbok Capital), and Alec Litowitz and Ross Laser’s Magnetar Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Weyerhaeuser Co. (NYSE:WY) but similarly valued. These stocks are Kansas City Southern (NYSE:KSU), Teladoc Health, Inc (NYSE:TDOC), Verisign, Inc. (NASDAQ:VRSN), Telefonica S.A. (NYSE:TEF), Consolidated Edison, Inc. (NYSE:ED), Realty Income Corporation (NYSE:O), and DTE Energy Company (NYSE:DTE). This group of stocks’ market values are similar to WY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KSU | 61 | 3303297 | 12 |

| TDOC | 43 | 3574007 | 1 |

| VRSN | 41 | 6102142 | -1 |

| TEF | 4 | 8903 | -2 |

| ED | 30 | 533462 | 8 |

| O | 23 | 221703 | 5 |

| DTE | 32 | 469838 | 6 |

| Average | 33.4 | 2030479 | 4.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.4 hedge funds with bullish positions and the average amount invested in these stocks was $2030 million. That figure was $663 million in WY’s case. Kansas City Southern (NYSE:KSU) is the most popular stock in this table. On the other hand Telefonica S.A. (NYSE:TEF) is the least popular one with only 4 bullish hedge fund positions. Weyerhaeuser Co. (NYSE:WY) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for WY is 65.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 21.8% in 2021 through October 11th and still beat the market by 4.4 percentage points. Hedge funds were also right about betting on WY as the stock returned 10.3% since the end of Q2 (through 10/11) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Weyerhaeuser Co (NYSE:WY)

Follow Weyerhaeuser Co (NYSE:WY)

Receive real-time insider trading and news alerts

Suggested Articles:

- Top 20 US Egg Producers in 2021

- 15 Fastest Growing Organisms In the world

- 10 Best Defensive Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.