Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts usually don’t make them change their opinion towards a company. This time it may be different. The coronavirus pandemic destroyed the high correlations among major industries and asset classes. We are now in a stock pickers market where fundamentals of a stock have more effect on the price than the overall direction of the market. As a result we observe sudden and large changes in hedge fund positions depending on the news flow. Let’s take a look at the hedge fund sentiment towards American Homes 4 Rent (NYSE:AMH) to find out whether there were any major changes in hedge funds’ views.

Hedge fund interest in American Homes 4 Rent (NYSE:AMH) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that AMH isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cemex SAB de CV (NYSE:CX), Five9 Inc (NASDAQ:FIVN), and Lithia Motors Inc (NYSE:LAD) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 115 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Ken Heebner of Capital Growth Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, economists warn of inflation flare up. So, we are checking out this backdoor gold play that has hit peak gains of 718% in a little over a year. We go through lists like the 10 best battery stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind let’s go over the new hedge fund action encompassing American Homes 4 Rent (NYSE:AMH).

Do Hedge Funds Think AMH Is A Good Stock To Buy Now?

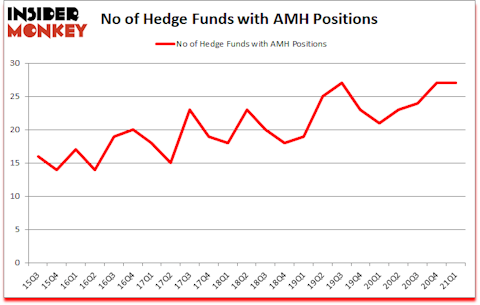

At the end of the first quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 21 hedge funds with a bullish position in AMH a year ago. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Long Pond Capital held the most valuable stake in American Homes 4 Rent (NYSE:AMH), which was worth $201.2 million at the end of the fourth quarter. On the second spot was Echo Street Capital Management which amassed $156.2 million worth of shares. D E Shaw, Waterfront Capital Partners, and V3 Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 59 North Capital allocated the biggest weight to American Homes 4 Rent (NYSE:AMH), around 9.3% of its 13F portfolio. Long Pond Capital is also relatively very bullish on the stock, earmarking 6.87 percent of its 13F equity portfolio to AMH.

Judging by the fact that American Homes 4 Rent (NYSE:AMH) has experienced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few hedgies who were dropping their entire stakes last quarter. Interestingly, Joseph Samuels’s Islet Management said goodbye to the biggest investment of the 750 funds watched by Insider Monkey, worth about $20.3 million in stock. Ken Heebner’s fund, Capital Growth Management, also cut its stock, about $3.6 million worth. These moves are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as American Homes 4 Rent (NYSE:AMH) but similarly valued. These stocks are Cemex SAB de CV (NYSE:CX), Five9 Inc (NASDAQ:FIVN), Lithia Motors Inc (NYSE:LAD), East West Bancorp, Inc. (NASDAQ:EWBC), Bright Horizons Family Solutions Inc (NYSE:BFAM), ICON Public Limited Company (NASDAQ:ICLR), and Pentair plc (NYSE:PNR). This group of stocks’ market caps are similar to AMH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CX | 24 | 471444 | 2 |

| FIVN | 45 | 1641865 | -2 |

| LAD | 40 | 2316536 | 1 |

| EWBC | 25 | 467070 | 1 |

| BFAM | 18 | 78337 | -2 |

| ICLR | 29 | 731050 | 0 |

| PNR | 30 | 775268 | 1 |

| Average | 30.1 | 925939 | 0.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.1 hedge funds with bullish positions and the average amount invested in these stocks was $926 million. That figure was $677 million in AMH’s case. Five9 Inc (NASDAQ:FIVN) is the most popular stock in this table. On the other hand Bright Horizons Family Solutions Inc (NYSE:BFAM) is the least popular one with only 18 bullish hedge fund positions. American Homes 4 Rent (NYSE:AMH) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for AMH is 51.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through July 9th and still beat the market by 6.7 percentage points. A small number of hedge funds were also right about betting on AMH as the stock returned 24% since the end of the first quarter (through 7/9) and outperformed the market by an even larger margin.

Follow American Homes 4 Rent (NYSE:AMH)

Follow American Homes 4 Rent (NYSE:AMH)

Receive real-time insider trading and news alerts

Suggested Articles:

- How to Best Use Insider Monkey To Increase Your Returns

- 21 Largest Generic Drug Companies

- 15 Youngest Tech Billionaires

Disclosure: None. This article was originally published at Insider Monkey.