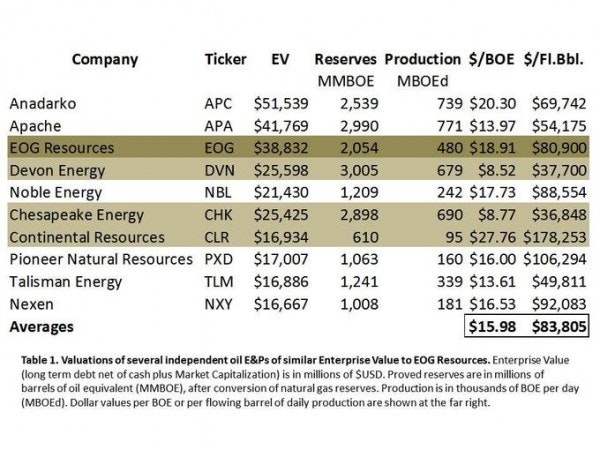

A look at reserve valuations in the larger cap independent oil & gas universe paints a widely varied picture. Barrels can be had for prices ranging from less than $9 to almost $30. The wide spread has a rational reason. No two companies’ reserves are easily comparable and simple value metrics ignore that fact. When a valuation looks out of whack with reality, it’s a good idea to try to find a rational reason. You often gain insight into the underlying story that’s driving the stock.

These ratios are useful and can help identify mispriced stocks, but some qualifiers are warranted. Mr. Market’s not always as dumb as he’s made out to be. Getting under the hood to understand why an apparent mispricing might be rational is necessary.

Apples aren’t oranges

Price per barrel of oil equivalent (BOE) is a useful metric, but it’s a blunt instrument. By its very nature, the BOE convention lumps apples in with oranges, so that companies with distinct reserve portfolios can be compared to each other. Like many things in life, the simple approach is useful and simultaneously, inadequate.

It’s difficult to lump companies like Apache Corporation (NYSE:APA) and Anadarko Petroleum Corporation (NYSE:APC) that have diverse portfolios, in with dedicated North American shale drillers like Devon Energy Corporation (NYSE:DVN), EOG Resources, Inc. (NYSE:EOG) or Chesapeake Energy Corporation (NYSE:CHK). Smaller independents like Noble Energy, Inc. (NYSE:NBL) and Nexen Inc. (USA) (NYSE:NXY) with sizeable international holdings and offshore operations arguably deserve yet another bushel for comparison. Pure offshore operators, provide yet another bushel.

Anadarko has considerable international and offshore drilling opportunities. The company will operate nine Deepwater drilling rigs in FY 2013. A quarter of its production comes from the Gulf or overseas. Devon is tethered to its North American shale plays. These are very different companies. With North American gas and mid-continent oil prices low, you can begin to understand Anadarko’s premium. Anadarko holds the acreage diversity of a Major in the wrapper of an Independent.

What’s in that barrel?

The brightest line separating companies right now is their oil/gas mix. Reserve reports normalize oil and gas reserves based on the energy they contain. When burned, 6 mcf (thousand cubic feet) of natural gas yields about the same amount of energy as 1 barrel (42 US gallons) of oil.

Natural gas reserves are mathematically converted into their equivalent amount of oil, totaled with liquid reserves and reported as BOE. The same can be done in reverse, converting barrels of oil to mcf, adding gas and reporting the sum as cubic feet equivalent (CFE). In either case, the goal is to quote reserves based on the energy they contain.

Since there’s no accounting for the disparate economic value of gas and oil, one BOE of Devon Energy Corporation (NYSE:DVN)’s gas-rich reserves simply aren’t equal in value to one BOE of EOG’s oil-rich reserves. At $3.50 per mcf, one BOE of natural gas fetches about $21 compared to roughly $100 for the barrel of oil. Given that wide spread, oil-rich portfolios warrant considerably higher valuations right now.

Nor is all oil equal. Oil quality differs considerably source by source. Devon’s heavy Canadian crude and syncrude fetch lower prices than EOG or Continental Resources, Inc. (NYSE:CLR)’s Bakken light sweet crude, because light sweet has more refining value. EOG has the industry leading acreage position in the oil-window of the Eagle Ford, and holds substantial Bakken acreage. Continental leads the red-hot Bakken. These high value oil-rich acreage positions account for their premium valuation.