Artisan Partners, an investment management company, released its “Artisan Focus Fund” first quarter 2023 investor letter. A copy of the same can be downloaded here. The first quarter was volatile, and macro-driven, the fund’s Investor Class fund ARTTX returned 3.34%, Advisor Class fund APDTX posted a return of 3.39%, and Institutional Class fund APHTX returned 3.38%, compared to a return of 7.50% for the S&P 500 Index. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Artisan Focus Fund highlighted stocks like Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in the first quarter 2023 investor letter. Headquartered in Hsinchu City, Taiwan, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is an integrated circuit and other semiconductor device manufacturer. On June 22, 2023, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) stock closed at $103.13 per share. One-month return of Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) was -0.08%, and its shares gained 20.03% of their value over the last 52 weeks. Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) has a market capitalization of $534.874 billion.

Artisan Focus Fund made the following comment about Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in its first quarter 2023 investor letter:

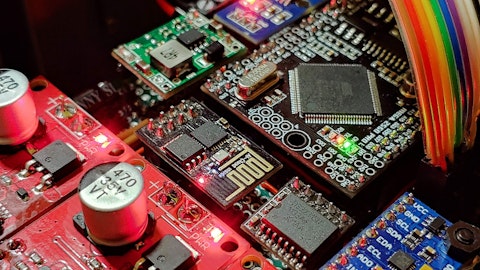

“Accelerated card sales are expected to grow from $5.2B to ~$50B in 2026. Just last year this $50B was expected to be $15B-$17B, signifying the massive inflection at hand. We believe this step function in demand almost entirely accrues to Nvidia, one of our winners in Q1. Advanced Micro Devices (AMD) currently does not have an AI-specific accelerated card but should be in the market by the end of the year, making it also compelling. Regardless, Nvidia’s software is the only game in town, and we believe it will ultimately be layered on top of AMD or any other cards that come up. We are early in this process and believe we have sized this market more accurately than other research providers, giving us an advantage in executing and generating alpha in this area over the coming years. Downstream, Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is also an important holding for us and one of only three companies that is currently able to manufacture these accelerated cards at scale. Among the three, Taiwan Semiconductor is the most advanced. As seen below, the mix shift in compute spending in the accelerated format represents a massive TAM shift.”

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 102 hedge fund portfolios held Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) at the end of first quarter 2023 which was 86 in the previous quarter.

We discussed Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) in another article and shared the list of A-rated stocks billionaires are loading up on. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Most Conservative Major Cities in the United States

- 10 Most Valuable EdTech Companies in the World

- Top 20 Free iPhone and iPad Games

Disclosure: None. This article is originally published at Insider Monkey.