Appleseed Fund, an investment management company released its first quarter 2023 investor letter. A copy of the same can be downloaded here. The fund’s Investor Class returned 5.42% over the six months that ended March 31, 2023, and outperformed the Morningstar Global Small/Midcap Index, which generated a 3.57% return. In addition, please check the fund’s top five holdings to know its best picks in 2023.

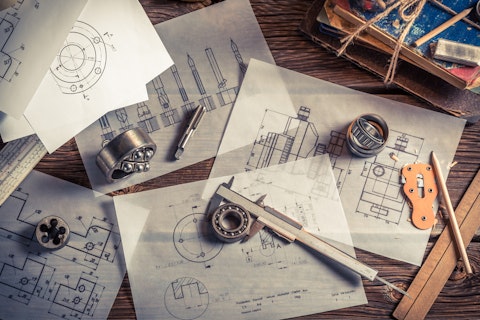

Appleseed Fund highlighted stocks like Stanley Black & Decker, Inc. (NYSE:SWK) in the first quarter 2023 investor letter. Headquartered in New Britain, Connecticut, Stanley Black & Decker, Inc. (NYSE:SWK) engages in tools and storage and industrial businesses. On May 30, 2023, Stanley Black & Decker, Inc. (NYSE:SWK) stock closed at $77.48 per share. One-month return of Stanley Black & Decker, Inc. (NYSE:SWK) was -12.94%, and its shares lost 34.32% of their value over the last 52 weeks. Stanley Black & Decker, Inc. (NYSE:SWK) has a market capitalization of $11.538 billion.

Appleseed Fund made the following comment about Stanley Black & Decker, Inc. (NYSE:SWK) in its Q1 2023 investor letter:

“During the most recent quarter, Appleseed Fund added three new equity holdings: Medtronic (MDT), Stanley Black & Decker, Inc. (NYSE:SWK), and Synovus Financial (SNV). Stanley Black & Decker is the world’s largest tool manufacturer. It produces power tools, hand tools, storage, digital tool solutions, lifestyle products, outdoor products, engineered fasteners, and other industrial equipment. 2022 was quite a forgettable year for the Company with its stock price falling by roughly 60%. Due to supply chain issues, bloated inventories, inflationary pressures, and weaker demand, the Company badly missed its original 2022 guidance. With recessionary fears, waning earnings momentum, a more elevated leverage profile, and reliance on the U.S. construction market, it is of no surprise how poorly the stock price behaved last year. In our view, the sell-off has been excessive with the stock price trading near March 2020 pandemic lows and at levels otherwise not seen since early 2014. We view the stock at washed-out levels with a favorable profile going forward.”

Shaiith/Shutterstock.com

Stanley Black & Decker, Inc. (NYSE:SWK) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 22 hedge fund portfolios held Stanley Black & Decker, Inc. (NYSE:SWK) at the end of first quarter 2023 which was 25 in the previous quarter.

We discussed Stanley Black & Decker, Inc. (NYSE:SWK) in another article and shared the list of best blue chip dividend stocks to buy. In addition, please check out our hedge fund investor letters Q1 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 16 Largest Pig Iron Producing Countries

- Rhenium Production by Country: Top 10 Countries

- 30 Best PC Games of All Time

Disclosure: None. This article is originally published at Insider Monkey.