ClearBridge Investments, an investment management company, released its “ClearBridge Large Cap Value Strategy” second quarter 2023 investor letter. A copy of the same can be downloaded here. The strategy outperformed its Russell 1000 Value Index benchmark in the second quarter. The strategy benefited from nine of the 11 sectors in which it was invested for the quarter on an absolute basis, while overall stock selection contributed to performance on a relative basis. In addition, please check the fund’s top five holdings to know its best picks in 2023.

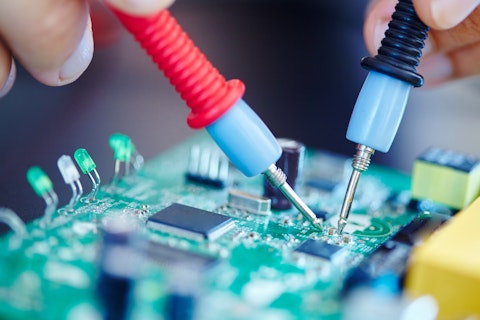

ClearBridge Large Cap Value Strategy highlighted stocks like Lam Research Corporation (NASDAQ:LRCX) in the second quarter 2023 investor letter. Headquartered in Fremont, California, Lam Research Corporation (NASDAQ:LRCX) manufactures and services wafer-processing semiconductor manufacturing equipment. On September 13, 2023, Lam Research Corporation (NASDAQ:LRCX) stock closed at $658.66 per share. One-month return of Lam Research Corporation (NASDAQ:LRCX) was 1.56%, and its shares gained 59.31% of their value over the last 52 weeks. Lam Research Corporation (NASDAQ:LRCX) has a market capitalization of $87.28 billion.

ClearBridge Large Cap Value Strategy made the following comment about Lam Research Corporation (NASDAQ:LRCX) in its Q2 2023 investor letter:

“At the same time, we re-initiated a position in semiconductor capital equipment company Lam Research Corporation (NASDAQ:LRCX), which we owned in 2020–21 and exited as its valuation hit our targets and fundamentals began to weaken. Lam’s tools are an essential part of the semiconductor manufacturing process and provide decades of annuity-like cash flows from servicing and spare parts. While the business is inherently cyclical, we believe that demand for semiconductor equipment will structurally grow due to the rising capital intensity of semi manufacturing, increased silicon content across all applications and a push by governments around the world to subsidize domestic production of chips. With the memory cycle nearing a bottom, expectations reset and the company able to expand its gross margins through ramping up new lower-cost facilities and other efficiency actions, we see more compelling risk/reward here versus Qualcomm.”

allstars/Shutterstock.com

Lam Research Corporation (NASDAQ:LRCX) is not on our list of 30 Most Popular Stocks Among Hedge Funds. AAs per our database, 69 hedge fund portfolios held Lam Research Corporation (NASDAQ:LRCX) at the end of second quarter which was 64 in the previous quarter.

We discussed Lam Research Corporation (NASDAQ:LRCX) in another article and shared the list of biggest technology companies. In addition, please check out our hedge fund investor letters Q2 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 Countries That Watch the Most Gay Content

- 17 Countries with Highest Child Marriage Rates in the World

- Long-Term Returns of Bill Ackman’s Activist Targets

Disclosure: None. This article is originally published at Insider Monkey.