Brown Capital Management, an investment management company, released its “The Brown Capital Management Mid Company Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. The Mid Company Fund returned 5.43% in the quarter compared to a 6.90% return for the Russell Midcap Growth Index. For the full year, the fund declined 37.12% compared to a -26.72% return for the benchmark. In addition, check the fund’s top five holdings to know its best picks in 2022.

The Brown Capital Management Mid Company Fund highlighted stocks like Entegris, Inc. (NASDAQ:ENTG) in the Q4 2022 investor letter. Headquartered in Billerica, Massachusetts, Entegris, Inc. (NASDAQ:ENTG) is a micro contamination control products manufacturing company. On March 17, 2023, Entegris, Inc. (NASDAQ:ENTG) stock closed at $81.66 per share. One-month return of Entegris, Inc. (NASDAQ:ENTG) was -4.47%, and its shares lost 39.44% of their value over the last 52 weeks. Entegris, Inc. (NASDAQ:ENTG) has a market capitalization of $12.563 billion.

The Brown Capital Management Mid Company Fund made the following comment about Entegris, Inc. (NASDAQ:ENTG) in its Q4 2022 investor letter:

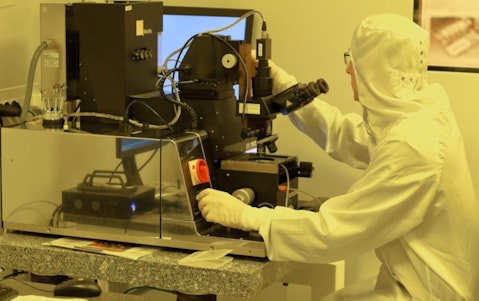

“Entegris, Inc. (NASDAQ:ENTG) is a world-class supplier of advanced materials and process solutions for the semiconductor, life-sciences and other high-tech industries. Semiconductors have become more relevant as the world digitalizes. These transformative technologies require advanced chips that consume more materials and are less tolerant of contaminants during manufacturing. Entegris operates at this intersection of material intensity and material purity, which has allowed it to grow 50% faster than the semiconductor industry over the past five years. Entegris is the largest independent semiconductor materials supplier with a unique set of assets that boost manufacturing yields, saving customers time and money. Consumables comprise 80% of sales, making it less subject to the industry’s volatile capital-expenditure swings. The company has a myriad of competitive advantages including scale, reputation and deep materials expertise that create a solid competitive moat.”

l-n-r2tVRjxzFM8-unsplash

Entegris, Inc. (NASDAQ:ENTG) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 28 hedge fund portfolios held Entegris, Inc. (NASDAQ:ENTG) at the end of the fourth quarter which was 24 in the previous quarter.

We discussed Entegris, Inc. (NASDAQ:ENTG) in another article and shared Artisan Partners’ views on the company. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 10 Best Stocks to Buy According to Chris Hohn

- 15 Most Promising Dividend Stocks According to Analysts

- 11 Best Coal Mining Stocks to Buy Today

Disclosure: None. This article is originally published at Insider Monkey.