A recurrent theme this year has been bad news out of China. First, and most obviously, the novel coronavirus; then equipment China sent to other countries to help combat the virus. For example, last week Pakistan received what they expected to be N-95 masks from China, only to find they were masks made out of underwear.

Bad news out of China has also included revelations of fraud at Luckin Coffee (LK) and at TAL Education Group (TAL). As market technician and hedge fund manager Tim Knight noted recently, that raises questions about what confidence investors can have in Chinese accounting in general.

Q1 2020 hedge fund letters, conferences and more

China Hasn’t Been Sending Its Best

Indeed, the recent news out of Luckin Coffee and TAL Education should give shareholders in Alibaba Group Holding Ltd (NYSE:BABA) pause. Jim Chanos, who recently covered his short on Luckin Coffee, suggested earlier this month that investors avoid Chinese stocks “like the plague“. Readers may recall that Chanos shorted Alibaba several years ago, and when he covered his short, said he was still skeptical about the company’s accounting.

In the event Chanos’s skepticism about Alibaba then – and his recent warning about Chinese stocks – proves prescient, let’s look at a couple of ways those who are long BABA shares can limit their risk.

Downside Protection For BABA Shares

For these two examples, I have assumed you have 500 shares of Alibaba and can tolerate a decline of 19% in over the next several months, but not one larger than that.

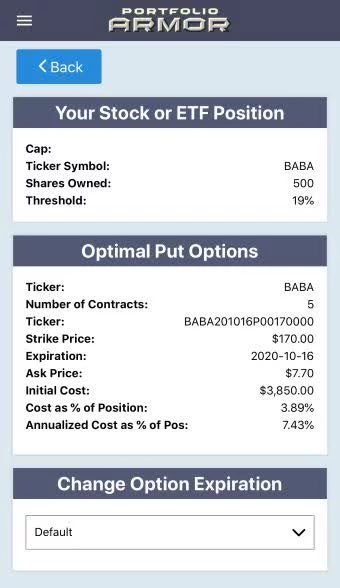

Uncapped Upside, Positive Cost

As of Tuesday’s close, these were the optimal, or least expensive, put options to hedge 500 shares of BABA against a greater-than-19% drop by mid-October.

Screen capture via Portfolio Armor.

The cost of this protection was $3,850, or 3.89% of position value, calculated conservatively, using the ask price of the puts (remember that, in practice, you can often buy and sell options at some price between the bid and ask). That worked out to an annualized cost of 7.43% of position value.

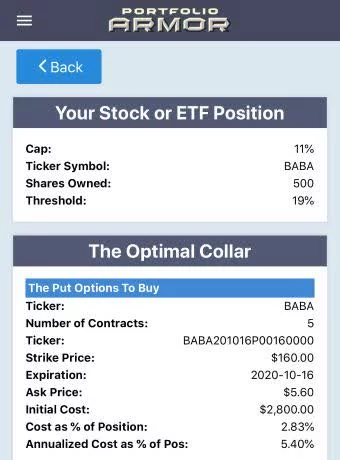

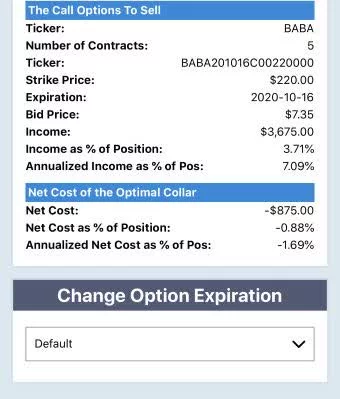

Capped Upside, Negative Cost

If you were willing to cap your possible upside at 11%, this was the optimal collar to protect against the same, >19% decline over the same time frame.

Screen captures via Portfolio Armor.

Here, the net cost was negative, meaning you would have collected a net credit of $875, or 0.88% of position value, assuming you placed both trades at the worst ends of their respective spreads. That worked out to an annualized cost of -1.69% of position value.

Wrapping Up – Other Options

If you’re bullish, and don’t want to cap your upside, but want to spend less to hedge, you could change your option expiration to nearer one and scan for optimal puts there (bear in mind that your annualized cost might be higher at some of those nearer expiration dates).

If you’re bearish, then you can sell your BABA shares, and buy the puts in the first hedge as a speculative bet against the company.

Disclosure: None.