Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Valeant and SunEdison, have not done well during the last 12 months due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average. The top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters. S&P 500 Index returned only 7.6% during the same period and less than 49% of its constituents managed to beat this return. Because their consensus picks have done well, we pay attention to what elite funds and billionaire investors think before doing extensive research on a stock. In this article, we take a closer look at Lowe’s Companies, Inc. (NYSE:LOW) from the perspective of those elite funds.

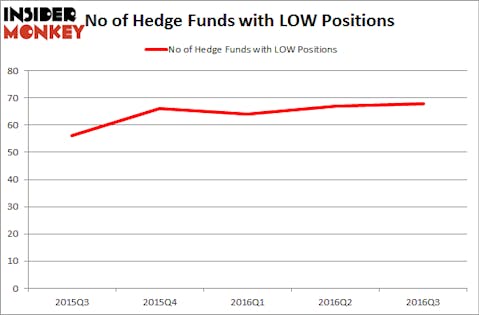

When it comes to Lowe’s Companies, Inc. (NYSE:LOW), money managers are getting more bullish, as the number of bullish hedge fund bets inched up by one to 68 during the third quarter. However, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as U.S. Bancorp (NYSE:USB), Danaher Corporation (NYSE:DHR), and Costco Wholesale Corporation (NASDAQ:COST) to gather more data points.

Follow Lowes Companies Inc (NYSE:LOW)

Follow Lowes Companies Inc (NYSE:LOW)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

auremar/Shutterstock.com

Keeping this in mind, we’re going to take a gander at the fresh action regarding Lowe’s Companies, Inc. (NYSE:LOW).

How have hedgies been trading Lowe’s Companies, Inc. (NYSE:LOW)?

At the end of the third quarter, a total of 68 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 1% from one quarter earlier. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Edgar Wachenheim’s Greenhaven Associates has the biggest position in Lowe’s Companies, Inc. (NYSE:LOW), worth close to $550.4 million, comprising 10.5% of its total 13F portfolio. Sitting at the No. 2 spot is David Cohen and Harold Levy’s Iridian Asset Management, with a $357.1 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish consist of John Overdeck and David Siegel’s Two Sigma Advisors and Gabriel Plotkin’s Melvin Capital Management.

Consequently, some big names were leading the bulls’ herd. Viking Global, managed by Andreas Halvorsen, assembled the biggest position in Lowe’s Companies, Inc. (NYSE:LOW). Viking Global had $195.5 million invested in the company at the end of the quarter. Melvin Capital Management also made a $79.4 million investment in the stock during the quarter. The following funds were also among the new LOW investors: Ken Griffin’s Citadel Investment Group, Curtis Macnguyen’s Ivory Capital (Investment Mgmt), and Alok Agrawal’s Bloom Tree Partners.

Let’s check out hedge fund activity in other stocks similar to Lowe’s Companies, Inc. (NYSE:LOW). We will take a look at U.S. Bancorp (NYSE:USB), Danaher Corporation (NYSE:DHR), Costco Wholesale Corporation (NASDAQ:COST), and BHP Billiton plc (ADR) (NYSE:BBL). This group of stocks’ market caps are closest to LOW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| USB | 41 | 4631330 | -7 |

| DHR | 54 | 1992183 | 0 |

| COST | 50 | 2377583 | 11 |

| BBL | 18 | 323894 | -1 |

As you can see these stocks had an average of 41 funds with bullish positions and the average amount invested in these stocks was $2.33 billion at the end of September. That figure was $3.27 billion in LOW’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table. On the other hand BHP Billiton plc (ADR) (NYSE:BBL) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Lowe’s Companies, Inc. (NYSE:LOW) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.