Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about WEX Inc (NYSE:WEX) in this article.

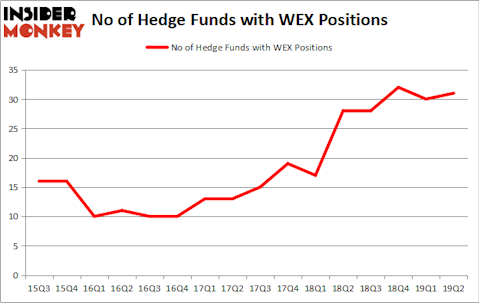

WEX Inc (NYSE:WEX) shareholders have witnessed an increase in enthusiasm from smart money recently. WEX was in 31 hedge funds’ portfolios at the end of the second quarter of 2019. There were 30 hedge funds in our database with WEX holdings at the end of the previous quarter. Our calculations also showed that WEX isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the eyes of most investors, hedge funds are seen as worthless, outdated financial tools of years past. While there are greater than 8000 funds in operation today, Our experts hone in on the leaders of this club, about 750 funds. These hedge fund managers preside over the lion’s share of the hedge fund industry’s total asset base, and by monitoring their inimitable stock picks, Insider Monkey has unearthed various investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points a year since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike this former hedge fund manager who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s take a gander at the latest hedge fund action regarding WEX Inc (NYSE:WEX).

What does smart money think about WEX Inc (NYSE:WEX)?

At the end of the second quarter, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in WEX over the last 16 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, PAR Capital Management, managed by Paul Reeder and Edward Shapiro, holds the most valuable position in WEX Inc (NYSE:WEX). PAR Capital Management has a $150.9 million position in the stock, comprising 2.5% of its 13F portfolio. Sitting at the No. 2 spot is Echo Street Capital Management, led by Greg Poole, holding a $112 million position; 2% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism contain Ken Griffin’s Citadel Investment Group, Steve Cohen’s Point72 Asset Management and Louis Bacon’s Moore Global Investments.

Consequently, key hedge funds were leading the bulls’ herd. Moore Global Investments, managed by Louis Bacon, initiated the most valuable position in WEX Inc (NYSE:WEX). Moore Global Investments had $41.6 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also initiated a $41.1 million position during the quarter. The other funds with brand new WEX positions are Anand Parekh’s Alyeska Investment Group, Tor Minesuk’s Mondrian Capital, and Sander Gerber’s Hudson Bay Capital Management.

Let’s also examine hedge fund activity in other stocks similar to WEX Inc (NYSE:WEX). We will take a look at Interpublic Group of Companies Inc (NYSE:IPG), Universal Display Corporation (NASDAQ:OLED), Vail Resorts, Inc. (NYSE:MTN), and EQT Midstream Partners LP (NYSE:EQM). This group of stocks’ market values resemble WEX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IPG | 32 | 881757 | 6 |

| OLED | 17 | 92063 | -1 |

| MTN | 33 | 485442 | 5 |

| EQM | 8 | 57609 | 0 |

| Average | 22.5 | 379218 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.5 hedge funds with bullish positions and the average amount invested in these stocks was $379 million. That figure was $575 million in WEX’s case. Vail Resorts, Inc. (NYSE:MTN) is the most popular stock in this table. On the other hand EQT Midstream Partners LP (NYSE:EQM) is the least popular one with only 8 bullish hedge fund positions. WEX Inc (NYSE:WEX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately WEX wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WEX were disappointed as the stock returned -2.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.