Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 823 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Equinix Inc (NASDAQ:EQIX) in this article.

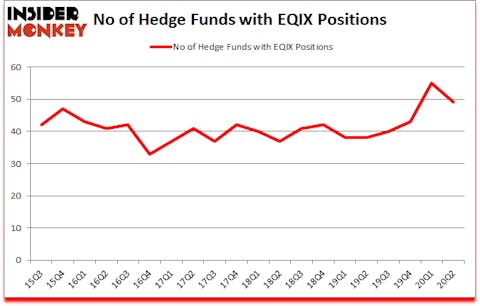

Equinix Inc (NASDAQ:EQIX) shareholders have witnessed a decrease in hedge fund sentiment lately. Equinix Inc (NASDAQ:EQIX) was in 49 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 55. There were 55 hedge funds in our database with EQIX positions at the end of the first quarter. Our calculations also showed that EQIX isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

David Harding of Winton Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to take a look at the fresh hedge fund action surrounding Equinix Inc (NASDAQ:EQIX).

Hedge fund activity in Equinix Inc (NASDAQ:EQIX)

At the end of the second quarter, a total of 49 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in EQIX over the last 20 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Rajiv Jain’s GQG Partners has the largest position in Equinix Inc (NASDAQ:EQIX), worth close to $824.4 million, amounting to 3.7% of its total 13F portfolio. Coming in second is Panayotis Takis Sparaggis of Alkeon Capital Management, with a $303.5 million position; 0.8% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions include Farallon Capital, Stuart J. Zimmer’s Zimmer Partners and Ian Simm’s Impax Asset Management. In terms of the portfolio weights assigned to each position Tensile Capital allocated the biggest weight to Equinix Inc (NASDAQ:EQIX), around 8.03% of its 13F portfolio. EMS Capital is also relatively very bullish on the stock, designating 5.57 percent of its 13F equity portfolio to EQIX.

Due to the fact that Equinix Inc (NASDAQ:EQIX) has faced falling interest from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedge funds who were dropping their entire stakes heading into Q3. Interestingly, Ken Griffin’s Citadel Investment Group dumped the largest position of all the hedgies watched by Insider Monkey, totaling about $210.7 million in stock. Josh Resnick’s fund, Jericho Capital Asset Management, also dumped its stock, about $50.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 6 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Equinix Inc (NASDAQ:EQIX) but similarly valued. We will take a look at Advanced Micro Devices, Inc. (NASDAQ:AMD), Enbridge Inc (NYSE:ENB), The TJX Companies, Inc. (NYSE:TJX), Target Corporation (NYSE:TGT), General Electric Company (NYSE:GE), NetEase, Inc (NASDAQ:NTES), and Duke Energy Corporation (NYSE:DUK). This group of stocks’ market valuations are similar to EQIX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMD | 51 | 2569197 | -11 |

| ENB | 28 | 379932 | 3 |

| TJX | 72 | 2347508 | 3 |

| TGT | 54 | 3159010 | 0 |

| GE | 57 | 3186232 | -1 |

| NTES | 38 | 4594320 | -1 |

| DUK | 33 | 906929 | -2 |

| Average | 47.6 | 2449018 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 47.6 hedge funds with bullish positions and the average amount invested in these stocks was $2449 million. That figure was $2314 million in EQIX’s case. The TJX Companies, Inc. (NYSE:TJX) is the most popular stock in this table. On the other hand Enbridge Inc (NYSE:ENB) is the least popular one with only 28 bullish hedge fund positions. Equinix Inc (NASDAQ:EQIX) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EQIX is 49.6. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and beat the market by 21 percentage points. Unfortunately EQIX wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on EQIX were disappointed as the stock returned 11% since the end of June (through 10/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Equinix Inc (NASDAQ:EQIX)

Follow Equinix Inc (NASDAQ:EQIX)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.