Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Cadence Design Systems Inc (NASDAQ:CDNS).

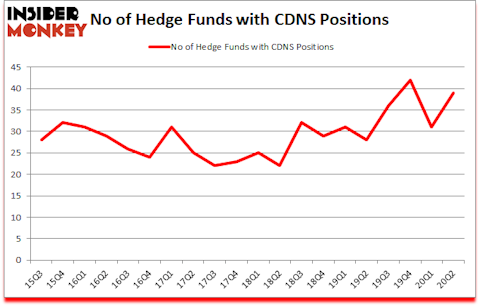

Is Cadence Design Systems Inc (NASDAQ:CDNS) a cheap investment now? Prominent investors were taking an optimistic view. The number of long hedge fund bets moved up by 8 lately. Cadence Design Systems Inc (NASDAQ:CDNS) was in 39 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 42. Our calculations also showed that CDNS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are tons of signals shareholders put to use to evaluate publicly traded companies. Two of the best signals are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite fund managers can outperform their index-focused peers by a healthy amount (see the details here).

Peter Algert of Algert Global

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Our analysis determined that presidential election polls were wrong heading into the 2020 election and we were able to make the most accurate predictions in the country after making adjustments for the biases in existing polls. For example we predicted comfortable Trump victories in Florida, North Carolina, Texas, Iowa, and Ohio. We also predicted a very narrow Biden victory of 0.4 points in Wisconsin when most pollsters were predicting 8 to 10 points Biden victories. We are waiting for the results of 5 more states, but our accuracy rate so far is 100% (see our predictions). You can subscribe to our free daily newsletter on our website to get email alerts whenever we publish an interesting article. With all of this in mind let’s take a peek at the new hedge fund action encompassing Cadence Design Systems Inc (NASDAQ:CDNS).

How have hedgies been trading Cadence Design Systems Inc (NASDAQ:CDNS)?

At the end of June, a total of 39 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 26% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CDNS over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Alkeon Capital Management, managed by Panayotis Takis Sparaggis, holds the most valuable position in Cadence Design Systems Inc (NASDAQ:CDNS). Alkeon Capital Management has a $493.4 million position in the stock, comprising 1.2% of its 13F portfolio. Sitting at the No. 2 spot is AQR Capital Management, managed by Cliff Asness, which holds a $161.2 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions consist of Noam Gottesman’s GLG Partners, Ian Simm’s Impax Asset Management and Brian Ashford-Russell and Tim Woolley’s Polar Capital. In terms of the portfolio weights assigned to each position Lunia Capital allocated the biggest weight to Cadence Design Systems Inc (NASDAQ:CDNS), around 3.91% of its 13F portfolio. Mondrian Capital is also relatively very bullish on the stock, dishing out 1.98 percent of its 13F equity portfolio to CDNS.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Woodline Partners, managed by Michael Rockefeller and KarláKroeker, established the most valuable position in Cadence Design Systems Inc (NASDAQ:CDNS). Woodline Partners had $14.3 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $13.6 million position during the quarter. The other funds with brand new CDNS positions are Tor Minesuk’s Mondrian Capital, Mika Toikka’s AlphaCrest Capital Management, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Cadence Design Systems Inc (NASDAQ:CDNS) but similarly valued. These stocks are The Kroger Co. (NYSE:KR), Microchip Technology Incorporated (NASDAQ:MCHP), Lloyds Banking Group PLC (NYSE:LYG), Franco-Nevada Corporation (NYSE:FNV), Manulife Financial Corporation (NYSE:MFC), AutoZone, Inc. (NYSE:AZO), and Yum! Brands, Inc. (NYSE:YUM). All of these stocks’ market caps are closest to CDNS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KR | 41 | 2361525 | -2 |

| MCHP | 33 | 890574 | -5 |

| LYG | 7 | 14116 | -2 |

| FNV | 23 | 1374566 | 2 |

| MFC | 19 | 171076 | -1 |

| AZO | 55 | 2395499 | 10 |

| YUM | 47 | 1633184 | 6 |

| Average | 32.1 | 1262934 | 1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.1 hedge funds with bullish positions and the average amount invested in these stocks was $1263 million. That figure was $1091 million in CDNS’s case. AutoZone, Inc. (NYSE:AZO) is the most popular stock in this table. On the other hand Lloyds Banking Group PLC (NYSE:LYG) is the least popular one with only 7 bullish hedge fund positions. Cadence Design Systems Inc (NASDAQ:CDNS) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for CDNS is 71.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on CDNS as the stock returned 14% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Cadence Design Systems Inc (NASDAQ:CDNS)

Follow Cadence Design Systems Inc (NASDAQ:CDNS)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.