While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, virus news and stimulus talks, many smart money investors are starting to get cautious towards the current bull run since March and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 30,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding HCA Healthcare Inc (NYSE:HCA).

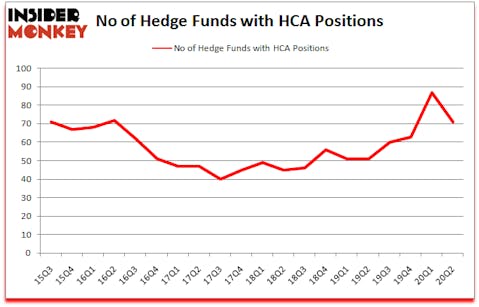

HCA Healthcare Inc (NYSE:HCA) was in 71 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 87. HCA investors should pay attention to a decrease in hedge fund sentiment recently. There were 87 hedge funds in our database with HCA holdings at the end of March. Our calculations also showed that HCA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 56 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Seth Klarman of Baupost Group

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind let’s take a look at the recent hedge fund action regarding HCA Healthcare Inc (NYSE:HCA).

What does smart money think about HCA Healthcare Inc (NYSE:HCA)?

Heading into the third quarter of 2020, a total of 71 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in HCA over the last 20 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Glenview Capital, managed by Larry Robbins, holds the most valuable position in HCA Healthcare Inc (NYSE:HCA). Glenview Capital has a $209.4 million position in the stock, comprising 5.8% of its 13F portfolio. On Glenview Capital’s heels is Lyrical Asset Management, led by Andrew Wellington and Jeff Keswin, holding a $207.9 million position; the fund has 4.1% of its 13F portfolio invested in the stock. Remaining peers that are bullish encompass Glenn Greenberg’s Brave Warrior Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and David Tepper’s Appaloosa Management LP. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to HCA Healthcare Inc (NYSE:HCA), around 14.26% of its 13F portfolio. Dendur Capital is also relatively very bullish on the stock, earmarking 11.02 percent of its 13F equity portfolio to HCA.

Due to the fact that HCA Healthcare Inc (NYSE:HCA) has witnessed a decline in interest from the entirety of the hedge funds we track, we can see that there was a specific group of money managers who sold off their full holdings last quarter. Intriguingly, Stephen DuBois’s Camber Capital Management cut the largest position of all the hedgies tracked by Insider Monkey, valued at an estimated $76.4 million in stock, and OrbiMed Advisors was right behind this move, as the fund said goodbye to about $63.8 million worth. These moves are interesting, as total hedge fund interest dropped by 16 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to HCA Healthcare Inc (NYSE:HCA). These stocks are NXP Semiconductors NV (NASDAQ:NXPI), DocuSign, Inc. (NASDAQ:DOCU), Splunk Inc (NASDAQ:SPLK), Orange SA (NYSE:ORAN), Phillips 66 (NYSE:PSX), Mizuho Financial Group Inc. (NYSE:MFG), and O’Reilly Automotive Inc (NASDAQ:ORLY). This group of stocks’ market caps are similar to HCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NXPI | 67 | 2214977 | 15 |

| DOCU | 57 | 2585727 | 10 |

| SPLK | 49 | 874330 | 12 |

| ORAN | 3 | 6480 | -2 |

| PSX | 42 | 362906 | -1 |

| MFG | 8 | 17393 | 2 |

| ORLY | 61 | 2930519 | 1 |

| Average | 41 | 1284619 | 5.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 41 hedge funds with bullish positions and the average amount invested in these stocks was $1285 million. That figure was $2240 million in HCA’s case. NXP Semiconductors NV (NASDAQ:NXPI) is the most popular stock in this table. On the other hand Orange SA (NYSE:ORAN) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks HCA Healthcare Inc (NYSE:HCA) is more popular among hedge funds. Our overall hedge fund sentiment score for HCA is 63.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 29.2% in 2020 through October 16th but still managed to beat the market by 19.7 percentage points. Hedge funds were also right about betting on HCA as the stock returned 39.2% since the end of June (through 10/16) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Hca Healthcare Inc. (NYSE:HCA)

Follow Hca Healthcare Inc. (NYSE:HCA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.