We are still in an overall bull market and many stocks that smart money investors were piling into surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Hedge funds’ top 3 stock picks returned 39.1% this year and beat the S&P 500 ETFs by nearly 13 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like U.S. Bancorp (NYSE:USB).

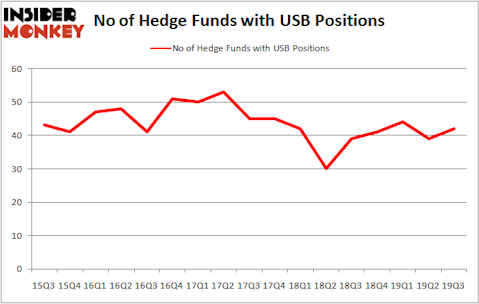

U.S. Bancorp (NYSE:USB) was in 42 hedge funds’ portfolios at the end of the third quarter of 2019. USB has seen an increase in support from the world’s most elite money managers recently. There were 39 hedge funds in our database with USB holdings at the end of the previous quarter. Our calculations also showed that USB isn’t among the 30 most popular stocks among hedge funds.

According to most traders, hedge funds are viewed as underperforming, old financial tools of years past. While there are over 8000 funds in operation at the moment, We choose to focus on the upper echelon of this club, around 750 funds. These money managers shepherd most of all hedge funds’ total asset base, and by paying attention to their highest performing stock picks, Insider Monkey has uncovered numerous investment strategies that have historically outstripped the market. Insider Monkey’s flagship short hedge fund strategy outstripped the S&P 500 short ETFs by around 20 percentage points a year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Paul Tudor Jones of Tudor Investment Corp

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the fresh hedge fund action encompassing U.S. Bancorp (NYSE:USB).

How have hedgies been trading U.S. Bancorp (NYSE:USB)?

At Q3’s end, a total of 42 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in USB over the last 17 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Warren Buffett’s Berkshire Hathaway has the most valuable position in U.S. Bancorp (NYSE:USB), worth close to $7.3303 billion, amounting to 3.4% of its total 13F portfolio. The second largest stake is held by Yacktman Asset Management, managed by Donald Yacktman, which holds a $262.3 million position; 3.2% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Dmitry Balyasny’s Balyasny Asset Management and Cliff Asness’s AQR Capital Management. In terms of the portfolio weights assigned to each position Basswood Capital allocated the biggest weight to U.S. Bancorp (NYSE:USB), around 4.66% of its portfolio. Berkshire Hathaway is also relatively very bullish on the stock, setting aside 3.41 percent of its 13F equity portfolio to USB.

As one would reasonably expect, key hedge funds have been driving this bullishness. Laurion Capital Management, managed by Benjamin A. Smith, established the biggest call position in U.S. Bancorp (NYSE:USB). Laurion Capital Management had $14.3 million invested in the company at the end of the quarter. David E. Shaw’s D E Shaw also made a $12.7 million investment in the stock during the quarter. The other funds with new positions in the stock are Michael Gelband’s ExodusPoint Capital, Gregg Moskowitz’s Interval Partners, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks similar to U.S. Bancorp (NYSE:USB). We will take a look at Lowe’s Companies, Inc. (NYSE:LOW), British American Tobacco plc (NYSE:BTI), Booking Holdings Inc. (NASDAQ:BKNG), and Bristol Myers Squibb Company (NYSE:BMY). All of these stocks’ market caps match USB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOW | 69 | 5706061 | 6 |

| BTI | 8 | 374309 | -1 |

| BKNG | 78 | 5427265 | 6 |

| BMY | 56 | 3842079 | -9 |

| Average | 52.75 | 3837429 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 52.75 hedge funds with bullish positions and the average amount invested in these stocks was $3837 million. That figure was $8308 million in USB’s case. Booking Holdings Inc. (NASDAQ:BKNG) is the most popular stock in this table. On the other hand British American Tobacco plc (NYSE:BTI) is the least popular one with only 8 bullish hedge fund positions. U.S. Bancorp (NYSE:USB) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. A small number of hedge funds were also right about betting on USB as the stock returned 8.5% during Q4 (through 11/22) and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.