We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Newmont Corporation (NYSE:NEM) and determine whether hedge funds skillfully traded this stock.

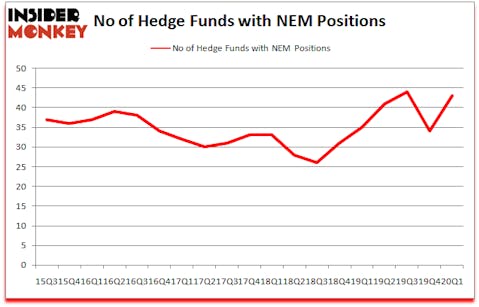

Is Newmont Corporation (NYSE:NEM) undervalued? The best stock pickers were becoming more confident. The number of bullish hedge fund positions improved by 9 lately. Our calculations also showed that NEM isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). NEM was in 43 hedge funds’ portfolios at the end of the first quarter of 2020. There were 34 hedge funds in our database with NEM holdings at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 36% through May 18th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Zilvinas Mecelis of Covalis Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, this trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost gold prices. So, we are checking out this junior gold mining stock. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s go over the fresh hedge fund action regarding Newmont Corporation (NYSE:NEM).

What have hedge funds been doing with Newmont Corporation (NYSE:NEM)?

At Q1’s end, a total of 43 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 26% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NEM over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Renaissance Technologies, holds the largest position in Newmont Corporation (NYSE:NEM). Renaissance Technologies has a $541.2 million position in the stock, comprising 0.5% of its 13F portfolio. On Renaissance Technologies’s heels is International Value Advisers, led by Charles de Vaulx, holding a $86.2 million position; the fund has 5.4% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions include Cliff Asness’s AQR Capital Management, D. E. Shaw’s D E Shaw and Eric Sprott’s Sprott Asset Management. In terms of the portfolio weights assigned to each position Heathbridge Capital Management allocated the biggest weight to Newmont Corporation (NYSE:NEM), around 6.63% of its 13F portfolio. International Value Advisers is also relatively very bullish on the stock, setting aside 5.45 percent of its 13F equity portfolio to NEM.

Consequently, specific money managers have been driving this bullishness. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the biggest position in Newmont Corporation (NYSE:NEM). Arrowstreet Capital had $17 million invested in the company at the end of the quarter. John Hempton’s Bronte Capital also made a $11.8 million investment in the stock during the quarter. The following funds were also among the new NEM investors: Steve Cohen’s Point72 Asset Management, Zilvinas Mecelis’s Covalis Capital, and Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors.

Let’s go over hedge fund activity in other stocks similar to Newmont Corporation (NYSE:NEM). We will take a look at Raytheon Company (NYSE:RTN), Ambev SA (NYSE:ABEV), Digital Realty Trust, Inc. (NYSE:DLR), and Eni SpA (NYSE:E). This group of stocks’ market values resemble NEM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RTN | 51 | 1829093 | -2 |

| ABEV | 9 | 254473 | -5 |

| DLR | 29 | 302894 | 3 |

| E | 5 | 35398 | -1 |

| Average | 23.5 | 605465 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.5 hedge funds with bullish positions and the average amount invested in these stocks was $605 million. That figure was $1024 million in NEM’s case. Raytheon Company (NYSE:RTN) is the most popular stock in this table. On the other hand Eni SpA (NYSE:E) is the least popular one with only 5 bullish hedge fund positions. Newmont Corporation (NYSE:NEM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on NEM as the stock returned 36.9% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Newmont Corp (NYSE:NEM)

Follow Newmont Corp (NYSE:NEM)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.