Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 823 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about W.R. Grace & Co. (NYSE:GRA).

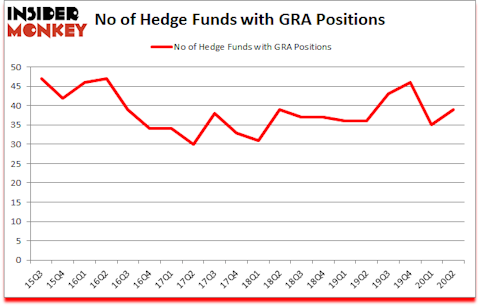

W.R. Grace & Co. (NYSE:GRA) has experienced an increase in activity from the world’s largest hedge funds recently. W.R. Grace & Co. (NYSE:GRA) was in 39 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 47. There were 35 hedge funds in our database with GRA positions at the end of the first quarter. Our calculations also showed that GRA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are assumed to be underperforming, outdated investment tools of the past. While there are over 8000 funds trading at present, We hone in on the aristocrats of this club, around 850 funds. It is estimated that this group of investors manage bulk of all hedge funds’ total capital, and by shadowing their inimitable equity investments, Insider Monkey has revealed numerous investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in March 2017. Our portfolio of short stocks lost 34% since February 2017 (through August 17th) even though the market was up 53% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

Jeffrey Gates of Gates Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Now let’s check out the recent hedge fund action surrounding W.R. Grace & Co. (NYSE:GRA).

How have hedgies been trading W.R. Grace & Co. (NYSE:GRA)?

At the end of June, a total of 39 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the previous quarter. The graph below displays the number of hedge funds with bullish position in GRA over the last 20 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, 40 North Management held the most valuable stake in W.R. Grace & Co. (NYSE:GRA), which was worth $501.2 million at the end of the third quarter. On the second spot was Soroban Capital Partners which amassed $138.8 million worth of shares. Gates Capital Management, Lyrical Asset Management, and Diamond Hill Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position 40 North Management allocated the biggest weight to W.R. Grace & Co. (NYSE:GRA), around 15.35% of its 13F portfolio. Atlantic Investment Management is also relatively very bullish on the stock, earmarking 8.57 percent of its 13F equity portfolio to GRA.

As industrywide interest jumped, key hedge funds have been driving this bullishness. Lyrical Asset Management, managed by Andrew Wellington and Jeff Keswin, established the most outsized position in W.R. Grace & Co. (NYSE:GRA). Lyrical Asset Management had $99.5 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also made a $9.8 million investment in the stock during the quarter. The other funds with brand new GRA positions are Javier Velazquez’s Albar Capital, John A. Levin’s Levin Capital Strategies, and Qing Li’s Sciencast Management.

Let’s also examine hedge fund activity in other stocks similar to W.R. Grace & Co. (NYSE:GRA). We will take a look at Nextera Energy Partners LP (NYSE:NEP), Envista Holdings Corporation (NYSE:NVST), RBC Bearings Incorporated (NASDAQ:ROLL), Mattel, Inc. (NASDAQ:MAT), Cosan Limited (NYSE:CZZ), Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH), and Clean Harbors Inc (NYSE:CLH). All of these stocks’ market caps are similar to GRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEP | 21 | 125356 | 0 |

| NVST | 21 | 395641 | -1 |

| ROLL | 17 | 61588 | 8 |

| MAT | 25 | 595357 | 8 |

| CZZ | 14 | 160277 | -1 |

| DCPH | 31 | 761061 | 3 |

| CLH | 19 | 237400 | -6 |

| Average | 21.1 | 333811 | 1.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.1 hedge funds with bullish positions and the average amount invested in these stocks was $334 million. That figure was $1297 million in GRA’s case. Deciphera Pharmaceuticals, Inc. (NASDAQ:DCPH) is the most popular stock in this table. On the other hand Cosan Limited (NYSE:CZZ) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks W.R. Grace & Co. (NYSE:GRA) is more popular among hedge funds. Our overall hedge fund sentiment score for GRA is 83.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Unfortunately GRA wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on GRA were disappointed as the stock returned -13.8% since the end of the second quarter (through 10/30) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow W R Grace & Co (NYSE:GRA)

Follow W R Grace & Co (NYSE:GRA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.