The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. We are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article we look at how hedge funds traded HCA Healthcare Inc (NYSE:HCA) and determine whether the smart money was really smart about this stock.

Is HCA Healthcare Inc (NYSE:HCA) a marvelous investment now? Investors who are in the know were taking an optimistic view at the end of March. The number of long hedge fund positions moved up by 24 in recent months. Our calculations also showed that HCA ranked 30th among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). It is hedge funds’ top hospital stock.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets, and we want to take advantage of the declining lithium prices amid the COVID-19 pandemic. So we are checking out investment opportunities like this one. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. For example we are checking out stocks recommended/scorned by legendary Bill Miller. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to review the fresh hedge fund action encompassing HCA Healthcare Inc (NYSE:HCA).

What does smart money think about HCA Healthcare Inc (NYSE:HCA)?

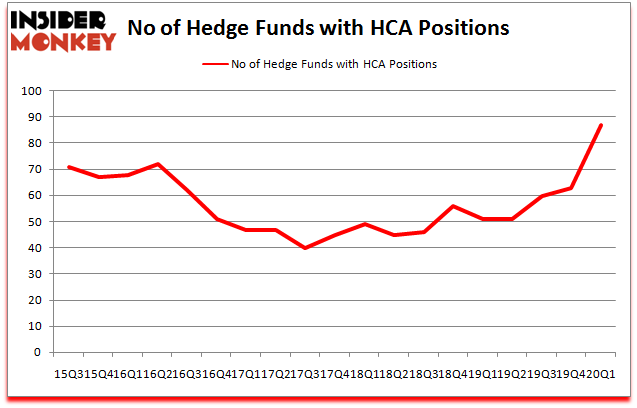

Heading into the second quarter of 2020, a total of 87 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 38% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in HCA over the last 18 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in HCA Healthcare Inc (NYSE:HCA) was held by Glenview Capital, which reported holding $252.7 million worth of stock at the end of September. It was followed by Lyrical Asset Management with a $237.4 million position. Other investors bullish on the company included Citadel Investment Group, Brave Warrior Capital, and Arrowstreet Capital. In terms of the portfolio weights assigned to each position Abrams Bison Investments allocated the biggest weight to HCA Healthcare Inc (NYSE:HCA), around 12.25% of its 13F portfolio. Solel Partners is also relatively very bullish on the stock, dishing out 11.7 percent of its 13F equity portfolio to HCA.

As aggregate interest increased, specific money managers have jumped into HCA Healthcare Inc (NYSE:HCA) headfirst. Brave Warrior Capital, managed by Glenn Greenberg, assembled the most outsized position in HCA Healthcare Inc (NYSE:HCA). Brave Warrior Capital had $124.2 million invested in the company at the end of the quarter. Anthony Bozza’s Lakewood Capital Management also made a $62.2 million investment in the stock during the quarter. The following funds were also among the new HCA investors: Farhad Nanji and Michael DeMichele’s MFN Partners, Gavin M. Abrams’s Abrams Bison Investments, and Kevin D. Eng’s Columbus Hill Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as HCA Healthcare Inc (NYSE:HCA) but similarly valued. These stocks are SBA Communications Corporation (REIT) (NASDAQ:SBAC), Monster Beverage Corp (NASDAQ:MNST), The Kraft Heinz Company (NASDAQ:KHC), and General Motors Company (NYSE:GM). This group of stocks’ market caps are similar to HCA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SBAC | 46 | 1835315 | 1 |

| MNST | 43 | 1843978 | -2 |

| KHC | 39 | 8314956 | 5 |

| GM | 53 | 3020405 | -22 |

| Average | 45.25 | 3753664 | -4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 45.25 hedge funds with bullish positions and the average amount invested in these stocks was $3754 million. That figure was $2171 million in HCA’s case. General Motors Company (NYSE:GM) is the most popular stock in this table. On the other hand The Kraft Heinz Company (NASDAQ:KHC) is the least popular one with only 39 bullish hedge fund positions. Compared to these stocks HCA Healthcare Inc (NYSE:HCA) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.3% in 2020 through June 25th and still beat the market by 16.8 percentage points. Unfortunately HCA wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on HCA were disappointed as the stock returned 3.9% during the second quarter (through June 25th) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Hca Healthcare Inc. (NYSE:HCA)

Follow Hca Healthcare Inc. (NYSE:HCA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.