The financial regulations require hedge funds and wealthy investors that exceeded the $100 million holdings threshold to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings to a certain extent level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on December 31st. We at Insider Monkey have made an extensive database of more than 887 of those established hedge funds and famous value investors’ filings. In this article, we analyze how these elite funds and prominent investors traded CrowdStrike Holdings, Inc. (NASDAQ:CRWD) based on those filings.

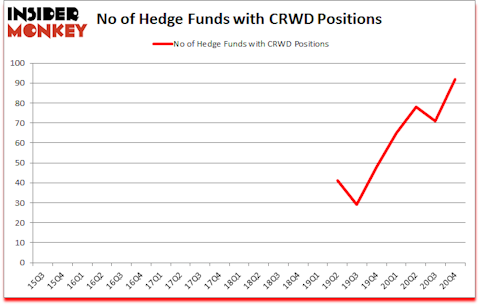

Is CrowdStrike Holdings, Inc. (NASDAQ:CRWD) the right investment to pursue these days? Hedge funds were betting on the stock. The number of bullish hedge fund positions moved up by 21 recently. CrowdStrike Holdings, Inc. (NASDAQ:CRWD) was in 92 hedge funds’ portfolios at the end of December. The all time high for this statistic was previously 78. This means the bullish number of hedge fund positions in this stock reached another all time high. Our calculations also showed that CRWD ranked #30 among the 30 most popular stocks among hedge funds (click for Q4 rankings). There were 71 hedge funds in our database with CRWD positions at the end of the third quarter.

Philippe Laffont of Coatue Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the CBD market is growing at a 33% annualized rate, so we are taking a closer look at this under-the-radar hemp stock. We go through lists like the 10 best biotech stocks under $10 to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s take a gander at the recent hedge fund action surrounding CrowdStrike Holdings, Inc. (NASDAQ:CRWD).

Do Hedge Funds Think CRWD Is A Good Stock To Buy Now?

At Q4’s end, a total of 92 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the third quarter of 2020. The graph below displays the number of hedge funds with bullish position in CRWD over the last 22 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Tiger Global Management LLC, managed by Chase Coleman, holds the largest position in CrowdStrike Holdings, Inc. (NASDAQ:CRWD). Tiger Global Management LLC has a $1.5965 billion position in the stock, comprising 4.1% of its 13F portfolio. The second largest stake is held by Coatue Management, led by Philippe Laffont, holding a $839.7 million position; 3.1% of its 13F portfolio is allocated to the stock. Remaining peers with similar optimism contain Alex Sacerdote’s Whale Rock Capital Management, David Goel and Paul Ferri’s Matrix Capital Management and D. E. Shaw’s D E Shaw. In terms of the portfolio weights assigned to each position Isomer Partners allocated the biggest weight to CrowdStrike Holdings, Inc. (NASDAQ:CRWD), around 10.4% of its 13F portfolio. Matrix Capital Management is also relatively very bullish on the stock, designating 6.87 percent of its 13F equity portfolio to CRWD.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Melvin Capital Management, managed by Gabriel Plotkin, assembled the biggest position in CrowdStrike Holdings, Inc. (NASDAQ:CRWD). Melvin Capital Management had $158.9 million invested in the company at the end of the quarter. Michael Kharitonov and Jon David McAuliffe’s Voleon Capital also initiated a $29.7 million position during the quarter. The other funds with brand new CRWD positions are Panayotis Takis Sparaggis’s Alkeon Capital Management, Suraj Parkash Chopra’s Force Hill Capital Management, and Stanley Druckenmiller’s Duquesne Capital.

Let’s now take a look at hedge fund activity in other stocks similar to CrowdStrike Holdings, Inc. (NASDAQ:CRWD). We will take a look at Canadian Pacific Railway Limited (NYSE:CP), Kimberly Clark Corporation (NYSE:KMB), Las Vegas Sands Corp. (NYSE:LVS), Lululemon Athletica inc. (NASDAQ:LULU), DoorDash, Inc. (NYSE:DASH), Capital One Financial Corp. (NYSE:COF), and Roper Technologies Inc. (NYSE:ROP). This group of stocks’ market caps are closest to CRWD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CP | 24 | 1540076 | -8 |

| KMB | 37 | 1420161 | -4 |

| LVS | 63 | 3065977 | 16 |

| LULU | 50 | 929013 | 0 |

| DASH | 38 | 3952490 | 38 |

| COF | 56 | 3028457 | 14 |

| ROP | 40 | 1348849 | -10 |

| Average | 44 | 2183575 | 6.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 44 hedge funds with bullish positions and the average amount invested in these stocks was $2184 million. That figure was $7242 million in CRWD’s case. Las Vegas Sands Corp. (NYSE:LVS) is the most popular stock in this table. On the other hand Canadian Pacific Railway Limited (NYSE:CP) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is more popular among hedge funds. Our overall hedge fund sentiment score for CRWD is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 12.3% in 2021 through April 19th and still beat the market by 0.9 percentage points. Unfortunately CRWD wasn’t nearly as successful as these 30 stocks and hedge funds that were betting on CRWD were disappointed as the stock returned 0.7% since the end of the fourth quarter (through 4/19) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the more diversified list of the top 30 most popular stocks among hedge funds as most of these stocks already outperformed the market since 2019.

Follow Crowdstrike Holdings Inc. (NASDAQ:CRWD)

Follow Crowdstrike Holdings Inc. (NASDAQ:CRWD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.