Coronavirus is probably the #1 concern in investors’ minds right now. It should be. On February 27th we published this article and predicted that US stocks will go down by at least 20% in the next 3-6 months. We also told you to short the market ETFs and buy long-term bonds. Investors who agreed with us and replicated these trades are up double digits whereas the market is down double digits. In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the fourth quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4 years and analyze what the smart money thinks of LyondellBasell Industries NV (NYSE:LYB) based on that data.

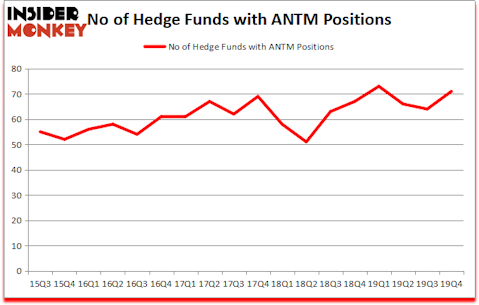

Anthem Inc (NYSE:ANTM) was in 71 hedge funds’ portfolios at the end of the fourth quarter of 2019. ANTM shareholders have witnessed an increase in hedge fund sentiment recently. There were 64 hedge funds in our database with ANTM positions at the end of the previous quarter. Our calculations also showed that ANTM isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 41 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Andreas Halvorsen of Viking Global

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now we’re going to analyze the fresh hedge fund action regarding Anthem Inc (NYSE:ANTM).

Hedge fund activity in Anthem Inc (NYSE:ANTM)

At the end of the fourth quarter, a total of 71 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 11% from the previous quarter. By comparison, 67 hedge funds held shares or bullish call options in ANTM a year ago. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Among these funds, Viking Global held the most valuable stake in Anthem Inc (NYSE:ANTM), which was worth $932.1 million at the end of the third quarter. On the second spot was Orbis Investment Management which amassed $694 million worth of shares. Farallon Capital, AQR Capital Management, and Glenview Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Crake Asset Management allocated the biggest weight to Anthem Inc (NYSE:ANTM), around 15.16% of its 13F portfolio. Thunderbird Partners is also relatively very bullish on the stock, dishing out 12.79 percent of its 13F equity portfolio to ANTM.

As one would reasonably expect, key money managers have been driving this bullishness. Suvretta Capital Management, managed by Aaron Cowen, established the most outsized position in Anthem Inc (NYSE:ANTM). Suvretta Capital Management had $124.4 million invested in the company at the end of the quarter. David Fear’s Thunderbird Partners also initiated a $79.5 million position during the quarter. The other funds with new positions in the stock are Martin Taylor’s Crake Asset Management, Christopher James’s Partner Fund Management, and Anthony Bozza’s Lakewood Capital Management.

Let’s also examine hedge fund activity in other stocks similar to Anthem Inc (NYSE:ANTM). These stocks are Cigna Corporation (NYSE:CI), Truist Financial Corporation (NYSE:TFC), Tesla Inc. (NASDAQ:TSLA), and CNOOC Limited (NYSE:CEO). This group of stocks’ market caps are similar to ANTM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CI | 72 | 4118635 | 7 |

| TFC | 35 | 875715 | 4 |

| TSLA | 51 | 3043687 | 19 |

| CEO | 14 | 235359 | -1 |

| Average | 43 | 2068349 | 7.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 43 hedge funds with bullish positions and the average amount invested in these stocks was $2068 million. That figure was $4834 million in ANTM’s case. Cigna Corporation (NYSE:CI) is the most popular stock in this table. On the other hand CNOOC Limited (NYSE:CEO) is the least popular one with only 14 bullish hedge fund positions. Anthem Inc (NYSE:ANTM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks lost 12.9% in 2020 through March 9th and beat the market by 1.9 percentage points. Hedge funds were also right about betting on ANTM as the stock returned -10.7% during the first quarter (through March 9th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.