The 800+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31st. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Nuance Communications Inc. (NASDAQ:NUAN).

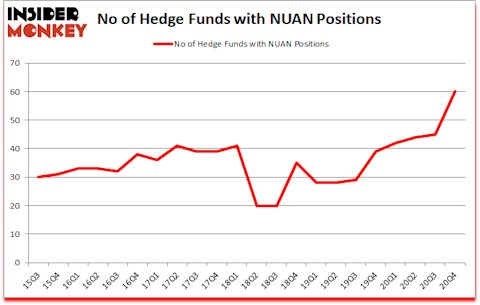

Nuance Communications Inc. (NASDAQ:NUAN) investors should pay attention to an increase in support from the world’s most elite money managers of late. Nuance Communications Inc. (NASDAQ:NUAN) was in 60 hedge funds’ portfolios at the end of December. The all time high for this statistic was previously 45. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 45 hedge funds in our database with NUAN positions at the end of the third quarter. Our calculations also showed that NUAN isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

In the eyes of most traders, hedge funds are seen as underperforming, outdated investment tools of yesteryear. While there are greater than 8000 funds trading today, Our experts choose to focus on the bigwigs of this club, around 850 funds. It is estimated that this group of investors manage bulk of the hedge fund industry’s total capital, and by monitoring their unrivaled picks, Insider Monkey has brought to light a few investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 197% since March 2017 (through March 2021) and beat the S&P 500 Index by 124 percentage points. You can download a sample issue of this newsletter on our website .

Philippe Laffont of Coatue Management

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Now let’s take a peek at the key hedge fund action encompassing Nuance Communications Inc. (NASDAQ:NUAN).

Do Hedge Funds Think NUAN Is A Good Stock To Buy Now?

Heading into the first quarter of 2021, a total of 60 of the hedge funds tracked by Insider Monkey were long this stock, a change of 33% from the third quarter of 2020. By comparison, 39 hedge funds held shares or bullish call options in NUAN a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Philippe Laffont’s Coatue Management has the biggest position in Nuance Communications Inc. (NASDAQ:NUAN), worth close to $732.6 million, accounting for 2.7% of its total 13F portfolio. On Coatue Management’s heels is Viking Global, led by Andreas Halvorsen, holding a $722.3 million position; 2% of its 13F portfolio is allocated to the stock. Other professional money managers that hold long positions contain Gabriel Plotkin’s Melvin Capital Management, Lone Pine Capital and Ricky Sandler’s Eminence Capital. In terms of the portfolio weights assigned to each position Andar Capital allocated the biggest weight to Nuance Communications Inc. (NASDAQ:NUAN), around 9.15% of its 13F portfolio. 12th Street Asset Management is also relatively very bullish on the stock, dishing out 7.35 percent of its 13F equity portfolio to NUAN.

As industrywide interest jumped, some big names were leading the bulls’ herd. Millennium Management, managed by Israel Englander, created the biggest position in Nuance Communications Inc. (NASDAQ:NUAN). Millennium Management had $85.3 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $79.5 million investment in the stock during the quarter. The other funds with brand new NUAN positions are Ben Jacobs’s Anomaly Capital Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Wen Han Li’s Andar Capital.

Let’s go over hedge fund activity in other stocks similar to Nuance Communications Inc. (NASDAQ:NUAN). We will take a look at Enel Americas S.A. (NYSE:ENIA), ASE Technology Holding Co., Ltd. (NYSE:ASX), Charles River Laboratories International Inc. (NYSE:CRL), ContextLogic Inc. (NASDAQ:WISH), Open Text Corporation (NASDAQ:OTEX), W.P. Carey Inc. (NYSE:WPC), and Howmet Aerospace Inc. (NYSE:HWM). All of these stocks’ market caps match NUAN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ENIA | 9 | 91500 | -2 |

| ASX | 9 | 183415 | -2 |

| CRL | 43 | 1187297 | 7 |

| WISH | 24 | 348110 | 23 |

| OTEX | 18 | 234136 | -1 |

| WPC | 18 | 197829 | -5 |

| HWM | 49 | 4092342 | 14 |

| Average | 24.3 | 904947 | 4.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.3 hedge funds with bullish positions and the average amount invested in these stocks was $905 million. That figure was $4678 million in NUAN’s case. Howmet Aerospace Inc. (NYSE:HWM) is the most popular stock in this table. On the other hand Enel Americas S.A. (NYSE:ENIA) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Nuance Communications Inc. (NASDAQ:NUAN) is more popular among hedge funds. Our overall hedge fund sentiment score for NUAN is 90. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 90.7% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 35 percentage points. These stocks returned 13.6% in 2021 through April 30th but still managed to beat the market by 1.6 percentage points. Hedge funds were also right about betting on NUAN as the stock returned 20.6% since the end of December (through 4/30) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Nuance Communications Inc. (NASDAQ:NUAN)

Follow Nuance Communications Inc. (NASDAQ:NUAN)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.