Is Equitable Holdings, Inc. (NYSE:EQH) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

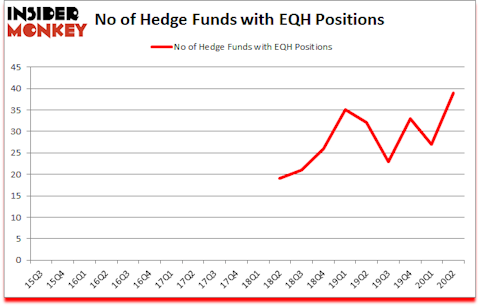

Equitable Holdings, Inc. (NYSE:EQH) has seen an increase in support from the world’s most elite money managers in recent months. Equitable Holdings, Inc. (NYSE:EQH) was in 39 hedge funds’ portfolios at the end of June. The all time high for this statistics is 35. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. There were 27 hedge funds in our database with EQH positions at the end of the first quarter. Our calculations also showed that EQH isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are tons of tools shareholders have at their disposal to size up stocks. Some of the most under-the-radar tools are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the top money managers can outperform the broader indices by a solid amount (see the details here).

Cliff Asness of AQR Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. Keeping this in mind we’re going to review the new hedge fund action encompassing Equitable Holdings, Inc. (NYSE:EQH).

Hedge fund activity in Equitable Holdings, Inc. (NYSE:EQH)

Heading into the third quarter of 2020, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 44% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards EQH over the last 20 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Pzena Investment Management held the most valuable stake in Equitable Holdings, Inc. (NYSE:EQH), which was worth $384.4 million at the end of the third quarter. On the second spot was Citadel Investment Group which amassed $246.3 million worth of shares. Sessa Capital, Point72 Asset Management, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Sessa Capital allocated the biggest weight to Equitable Holdings, Inc. (NYSE:EQH), around 12.01% of its 13F portfolio. Soapstone Capital is also relatively very bullish on the stock, earmarking 2.78 percent of its 13F equity portfolio to EQH.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most valuable position in Equitable Holdings, Inc. (NYSE:EQH). Arrowstreet Capital had $41.7 million invested in the company at the end of the quarter. Pasco Alfaro / Richard Tumure’s Miura Global Management also made a $7.8 million investment in the stock during the quarter. The following funds were also among the new EQH investors: David Rodriguez-Fraile’s BlueMar Capital Management, Peter Seuss’s Prana Capital Management, and Parsa Kiai’s Steamboat Capital Partners.

Let’s check out hedge fund activity in other stocks similar to Equitable Holdings, Inc. (NYSE:EQH). We will take a look at RenaissanceRe Holdings Ltd. (NYSE:RNR), Clarivate Plc (NYSE:CCC), Charles River Laboratories International Inc. (NYSE:CRL), Natura &Co Holding S.A. (NYSE:NTCO), Brookfield Renewable Partners L.P. (NYSE:BEP), Elanco Animal Health Incorporated (NYSE:ELAN), and James Hardie Industries plc (NYSE:JHX). All of these stocks’ market caps are similar to EQH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNR | 41 | 870861 | 11 |

| CCC | 45 | 1300868 | 17 |

| CRL | 41 | 1050760 | 5 |

| NTCO | 5 | 85507 | -3 |

| BEP | 5 | 30355 | 2 |

| ELAN | 30 | 212753 | 4 |

| JHX | 5 | 11376 | 1 |

| Average | 24.6 | 508926 | 5.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.6 hedge funds with bullish positions and the average amount invested in these stocks was $509 million. That figure was $1112 million in EQH’s case. Clarivate Plc (NYSE:CCC) is the most popular stock in this table. On the other hand Natura &Co Holding S.A. (NYSE:NTCO) is the least popular one with only 5 bullish hedge fund positions. Equitable Holdings, Inc. (NYSE:EQH) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for EQH is 82.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 23% in 2020 through October 30th and still beat the market by 20.1 percentage points. Hedge funds were also right about betting on EQH as the stock returned 12.3% since the end of Q2 (through 10/30) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Equitable Holdings Inc. (NYSE:EQH)

Follow Equitable Holdings Inc. (NYSE:EQH)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.